Burkina Faso, a landlocked country in the heart of the Sahel region, was already facing difficult challenges when the COVID-19 outbreak occurred. The security context had been deteriorating since June 2018, with an upsurge in violent attacks by terrorists and criminal groups. The country is now experiencing a rapidly growing crisis in internally displaced persons (IDPs); the number of IDPs increased from 50,000 in January 2019 to over 1 million in August 2020. The country is also facing a food security crisis, as 3.3 million people, or roughly 20 percent of the population, are food insecure. In this context, COVID-19 containment and mitigation measures plunged the country into an economic crisis. The compounding effect of concurrent crisis (IDPs, food insecurity, and now the health pandemic) increased budgetary pressures, and the 2020 deficit is projected at 6 percent of GDP, more than twice as high as the pre-COVID-19 projections. GDP growth is projected to collapse to -2 percent, or four percentage points less than the pre-COVID-19 figure. With a shrinking economy and the need to borrow to finance the revised 2020 and 2021 budgets, national public debt is expected to increase from 42.7 percent of GDP in 2019 to over 47 percent of GDP in 2020.

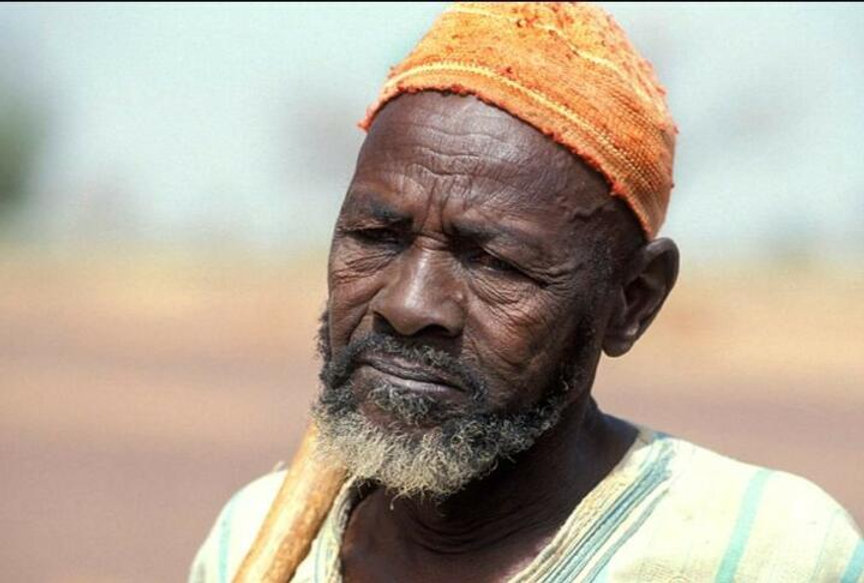

Photo: World Bank

The Government of Burkina Faso adopted an Emergency Response and Recovery Plan. However, the plan faces a financing gap, particularly for the economic recovery of the private sector, which is dominated by micro, small, and medium enterprises (MSMEs). Of the 65,000 formal enterprises registered in Burkina Faso, only 500 have an annual turnover of more than CFAF 1 billion (US$1.8 million). The country is home to more than 1.4 million informal MSMEs.

In response to the COVID-19 crisis and the potential compounding effects with other threats, the Financial Inclusion Support Project, or FISP, was restructured to assist the government in crowding in private capital from the financial sector to support the private sector, particularly SMEs during this difficult period. Firms’ inability to access finance could potentially lead to bankruptcy, loss of jobs and income, which could affect the financial sector, and could eventually fall on government as liabilities.

The project restructuring helped achieve three important aims.

First, it helped to provide needed information for informed decision-making. To quantify the impact of pandemic and disaster shocks on MSMEs, two analysis were carried out: a nationwide pulse survey at firm level and an assessment of financial impacts of COVID-19 and disaster shocks on MSMEs. To inform the design of future financial and technical support programs, these analysis aimed to identify the measures taken by SMEs to mitigate the impacts of the COVID-19 pandemic on their business performance, and the needs of companies in the short, medium, and long term to deal with the economic crisis caused by COVID-19. At the peak of the crisis in April 2020, 86 percent of companies reported a drop in sales. Six months later, 76 percent of firms continued to face a drop in sales; and 55 percent of firms reporting drop in sales reported a decrease of more than 50 percent in sales over the last 30 days before their interview. The diagnostics showed an overall decrease in revenues for 93 percent of economic actors, and three in four companies reported having financial problems. Indeed, 34 percent of firms reported not having enough cash to cover their expenses beyond three months and have called for policies and solutions to reduce costs and increase resources.

Second, the project restructuring enhanced the ability of the FISP existing partial portfolio credit guarantee (PPCG) to respond to the crisis. With initial capital of US$35 million, the FISP set up a PPCG fund to guarantee loans to SMEs, the agriculture sector, and women entrepreneurs. A new crisis response window within the existing credit guarantee fund was added to support small firms affected by the pandemic. The crisis window covers restructured loans and short-term working capital loans to MSMEs currently having difficulty (either because of the COVID-19 pandemic or a drought) but still likely to return to long-term profitability. Three sources of financing are used to establish the crisis response window: unallocated resources within the project budget (5 percent, or US$5 million); reallocation and repurpose from others components of the project (US$5 million); and a grant from the Global Risk Financing Facility (GRiF) (US$10 million). A US$20 million crisis response window can guarantee US$45 million in loans by participating financial institutions. The new crisis window is in high demand and able to cover only 20 percent of the participating financial institutions—six banks and three microfinance institutions (MFIs)—for this type of guarantee coverage. The project will therefore continue exploring market-based solutions to address the crisis window, given Burkina Faso’s risk profile. Additionally, banks and MFIs will benefit from technical assistance on the assessment and management of climate and disaster risk impacts.

Lastly, the project supports the Government of Burkina Faso in developing its first disaster risk financing (DRF) strategy. Previously, when a disaster shock occurred, the government relied mainly on external support; this has been the case every year since 2010. In the face of recurrent threats coupled with the global slowdown, the Ministry of Finance has recognized the need for a more sustainable financial protection strategy to provide timely support to households and MSMEs while alleviating the burden on the budget. While Burkina Faso has some mechanisms to respond to disasters (e.g., social safety nets, national funds, a small-scale crop insurance pilot, sovereign risk transfer), there is no strategic disaster risk financing mechanism to coordinate actions. That is why the World Bank is supporting the Government of Burkina Faso in undertaking a comprehensive DRF diagnostic to identify and coordinate the most suitable financing instruments and sources of finance for the different types and severities of hazards the country is facing.

Burkina Faso is known as the country of “Les Hommes Intègres” — that is, the country of “upright and honest men.” In accordance with this label, the Ministry of Finance is committed to strengthening the country’s financial resilience to shocks by setting up the right instruments to protect households, MSMEs, and public finance.

This article was originally published by World Bank.