During a webinar we recently attended on small and medium enterprise (SME) finance, someone commented: “SMEs are like the Kardashians. We follow them, but we don’t really know why.”

At least in the case of SMEs in the Arab world, here’s why the development community should be paying attention.

In the Arab world, SMEs account for 97 percent of businesses, employ half of the total labour force, represent up to 40 percent of GDP and have the potential to create 8 million jobs by 2025, according to research from the IMF. In a region where millions of new jobs are needed every year to absorb new entrants into the labour market, SMEs present a big opportunity to drive economic growth.

Photo: CGAP

The global development community has long recognized that financial services can enable entrepreneurs to start and grow SMEs. Services like long-term and working capital, business process support, and payments make it easier for SMEs to invest in expansion, manage risks and improve operational efficiency. However, the aforementioned IMF research also shows that SMEs in the Arab world face the largest financing gap in the world and receive the lowest percentage of bank credit. Due to information asymmetries, perceived lack of bankability, and high costs to serve, financial service providers (FSPs) have often focused on other client segments.

The SME Finance Forum estimates the region’s SME finance gap at $123 billion. In other words, SMEs need US$123 billion to realize their full potential, including in job creation. Despite this financing need, most fintechs are not addressing the gap, with some notable exceptions.

Only 5% of fintechs in the Arab world finance SMEs

Last year, CGAP mapped fintechs in the Arab world. As part of this exercise, we concluded that if FSPs in the six countries with the most fintechs in the region expanded financial services to just half of the excluded individuals and companies, they could generate $7 billion in revenue. In that calculation, bridging 50% of the SME financing gap makes up two-thirds of this revenue potential.

Oddly, only 80 of the 400 active fintech solutions we identified across the region (20%) are broadly targeting SMEs. Of these, just 27% finance SMEs. That’s only 5% of the total number of fintechs and pales in comparison to the untapped market.

This small group of fintechs includes digital lenders that offer working capital loans and invoice financing as well as crowdfunding solutions. Some of the crowdfunding solutions source capital from retail and institutional lenders, while others source from individual depositors, both domestically and internationally.

This group also includes fintechs that indirectly facilitate SME financing by improving traditional FSPs’ lending capabilities. They enhance various aspects of the SME financing process — for example, by providing valuation tools or underwriting services. Such tools are needed more than ever for FSPs to play a significant role in extending credit to SMEs during the COVID-19 pandemic and other crises across the region. For instance, Liwwa, a large SME financing platform operating in Jordan and Egypt, typically provides direct financing to SMEs. But it has now partnered with the Capital Bank of Jordan to also provide underwriting-as-a-service to accelerate the bank’s assessment and speed of SME lending.

Most fintechs serving SMEs offer payments and digital solutions to help companies digitize and grow

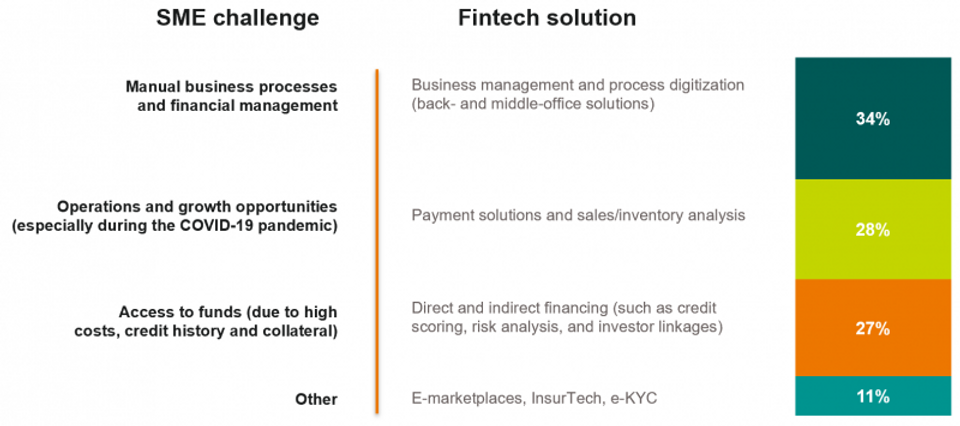

Most of the 80 fintech solutions we identified for SMEs focus not on financing, but on improving SME business processes. The majority do this by digitizing recordkeeping and inventories; by providing cloud-based management systems or digital solutions for human resources (HR), finance and accounting processes; or by helping businesses to find new customers online. For instance, Tunisia’s Swiver offers online business management solutions for professional artisans and SMEs. These solutions aim to simplify billing procedures and accounting processes.

Digital payments make up 44% of all fintech solutions in the region, but only 28% of the SME-focused solutions. Some fintechs aim to help SMEs find new sales avenues by integrating easy and secure payment solutions into SMEs’ online stores or by facilitating in-person merchant payments through point-of-sale (POS) technology. JumiaPay, by the African-born e-commerce platform Jumia, offers digital payments solutions that enable SMEs to find customers online. This is a valuable service at a time when many stores are closed due to the pandemic.

Other fintechs go a step further and offer value-added services, such as sales data analytics and customer loyalty schemes. One example is Zeal Rewards, an Egypt-based payments fintech that enables users to link bank debit and credit cards to the Zeal app and make in-store, QR code-based payments while collecting digital loyalty points. Zeal’s partners — many of which are small merchants such as cafes and beauty salons — can utilize Zeal’s dashboard, which forecasts future customer spending based on customers’ existing data.

Although such solutions don't tackle the big market potential of SME finance per se, they provide an excellent digital base for credit scoring down the line.

Although such solutions don't tackle the big market potential of SME finance per se, they provide an excellent digital base for credit scoring down the line.

Breakdown of SME-focused fintechs in the Arab world

Image: CGAP

Fintechs can’t do it alone – most are SMEs themselves

Fintechs in the Arab world are often SMEs themselves and face challenges similar to those of the clients they are trying to support. Those focusing on SMEs are young and small companies, with an average of 3.7 years of operations and less than 50 employees. Two-thirds of them focus on only three countries (United Arab Emirates, Saudi Arabia and Egypt), and their regional operations are limited.

For fintechs to reach their potential to close the region’s SME financing gap, they will need more enabling financial and physical infrastructure to make financial services more accessible and useful to SMEs and their customers. This includes mobile and internet connections, interoperable payments, credit bureaus that include SMEs, and digital identification systems. Sufficient financial and human capital, including a workforce with digital skills, are also essential to scale operations and meet client needs.

COVID-19 has highlighted not only the role fintechs across the Arab world can play in supporting SMEs, but also why it’s important for FSPs, regulators and other players to speed up efforts to help these businesses survive and thrive. As CGAP’s work has shown, those who do are looking at a multi-billion-dollar opportunity. So, let’s “keep up” with the SMEs.

This article was originally published by CGAP.