If you haven't figured it out by now, I'm all about segmenting because it's hard for me to understand something without a reference point or comparison.

For example, how can you understand the size of something in a picture without comparing it to something else? Have you ever put a banana in a picture for perspective? Well, you could say I’m always looking for the banana.

As usual, I planned on writing one blog on funds, but it turned out to be too long. So, you guessed it, it became a miniseries. In this case, a three-part miniseries. Highlights of part 1:

-

Segmenting helps to understand similarities and differences between funds.

-

What’s technically a fund versus a balance sheet lender?

-

Does it make sense for donor agencies to support one “type” of fund more than others?

Segmenting agricultural investment funds for development

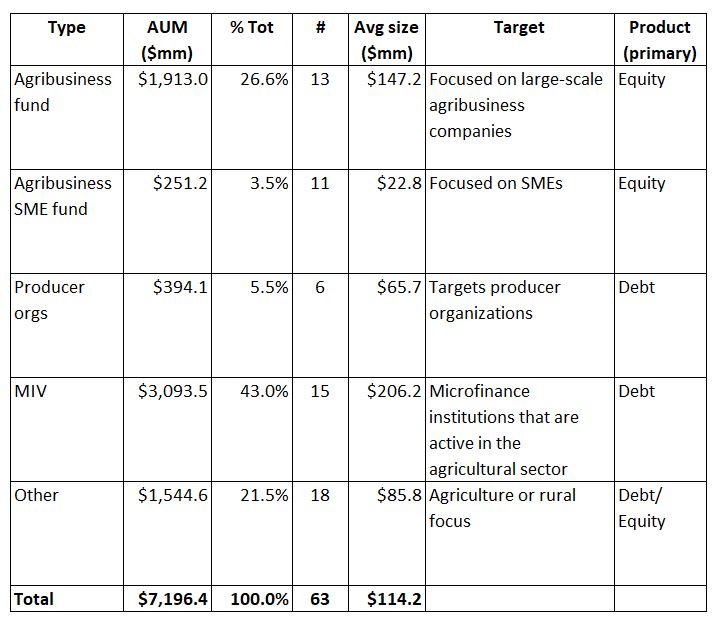

As a starting point, I'll be using this report from the Food and Agriculture Organization of the United Nations (FAO) that segments 63 funds representing $7.1bn in assets under management (AUM) (hat tip to Samuel Ledermann from The George Washington University (GW) who originally pointed this report out to me). ISF also does a segmentation of agricultural investment funds that is a little more sophisticated, but which is also a little bit more difficult to understand, at least for me. One thing I do like about ISF is that they have put their funds into a database online. On the other hand, I had to type in all the data from the FAO report into a spreadsheet myself. If anyone wants a copy, I can clean it up and share. (If Calvin Miller, the FAO report author, happens to be reading this, I wonder if he would be willing to share his spreadsheet?)

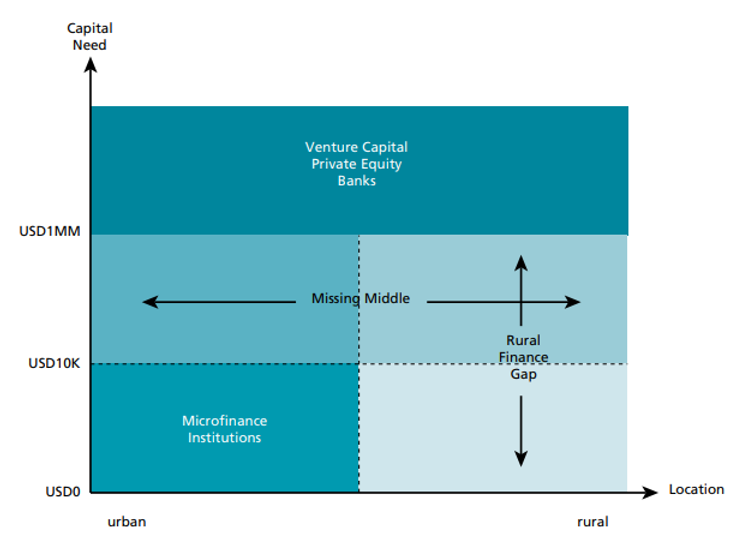

First off, the FAO report has a nice graphic on page 59 depicting the missing middle, i.e., the financing gap between microfinance and bank lending, targeted by Aceli Africa (agricultural small- and medium-sized enterprises (agri-SMEs)). One Acre Fund focuses on the bottom right (smallholder farmers). I think it's interesting that venture capital and private equity are grouped together with banks, i.e., they do not target the missing middle either.

The first publication I can find of this graphic is from this 2009 article coincidentally written by Aceli founder, Brian Milder, from when he worked at Root Capital.

The FAO report segments funds into five “types,” which I summarize below.

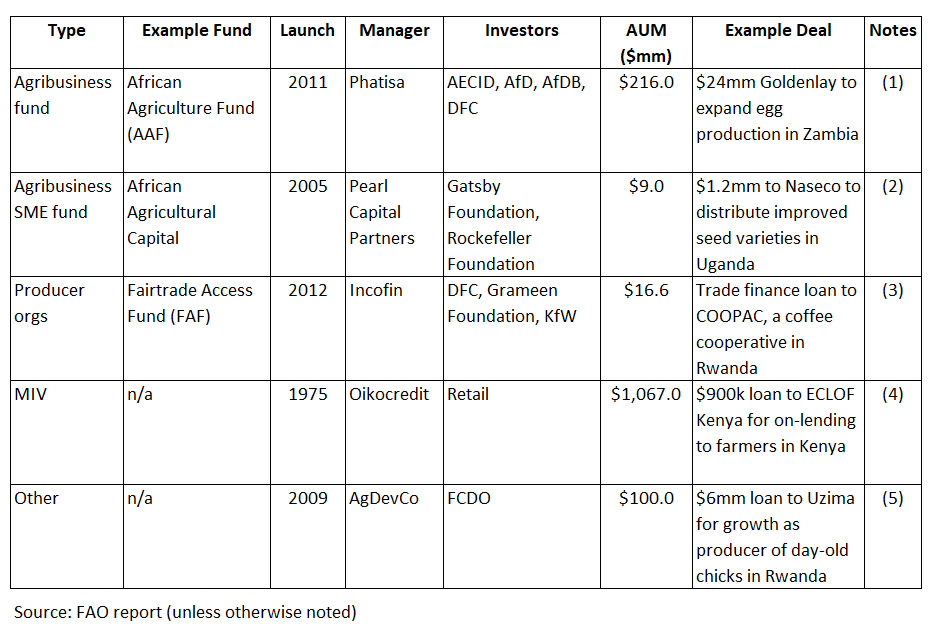

In the table below, I've included an example fund for each type (based on the FAO report’s categorization), examples of investors in the fund and an example deal that the fund has made.

Notes on table:

-

Goldenlay: https://fliphtml5.com/hucy/msld/basic Fund overview: https://www.ifad.org/documents/38714170/41079493/TAF_ImpactBrief.pdf/ Investors: https://impactyield.com/funds/african-agriculture-fund-l-l-c-aaf

-

Naseco: https://impactalpha.com/pearl-capital-backs-ugandan-seed-distributor-naseco/

-

Annual report: https://incofinfaf.com/wp-content/uploads/2021/05/2020-Annual-Report-FAF.pdf COOPAC loan amount not disclosed, but fund had average ticket size of $800k

-

ECLOF Kenya: https://www.oikocredit.coop/en/what-we-do/partners/partner-detail/30786/eclof-kenya-limited (Need to download PDF to see ECLOF Kenya loan amount)

-

Uzima: https://www.agdevco.com/our-investments/by-investment/Uzima-Chicken

Investment fund versus balance sheet lender

The above table also highlights two different ways organizations can be structured to channel capital.

Investment fund: An investment fund has two distinct parties, the fund itself and the fund manager. Sometimes it gets confusing because the fund is so closely identified with the fund manager. Examples of fund managers from the earlier table include Phatisa, Pearl Capital Partners and Incofin.

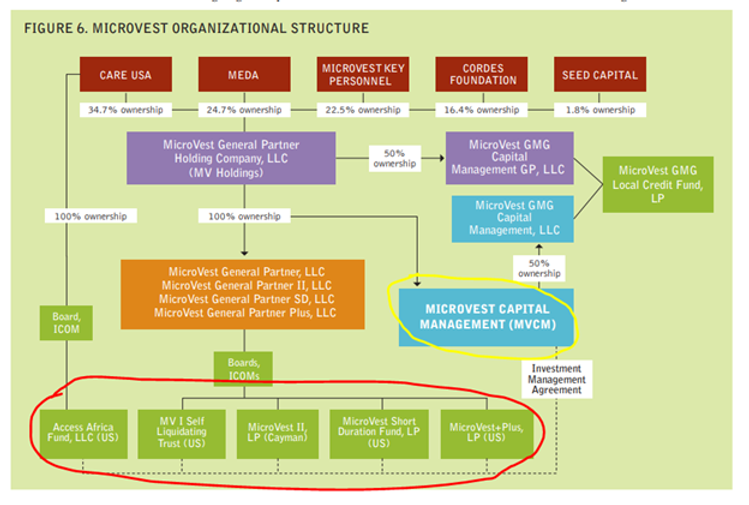

The chart below is the organizational structure for Microvest, a microfinance fund manager, from a 2013 case study. I chose to use them as an example because I am familiar with them from my previous job at Calvert Impact Capital (they were also recently acquired by DAI). The chart looks complicated, but you can just think of the yellow circle as the fund manager and the green boxes circled in red are the separate, individual funds they manage. Each fund has its own investment strategy and investors, though there may be overlap of both between the funds.

Balance sheet lender: A balance sheet lender is another way of saying that there is only one party involved, not two like for investment funds. To oversimplify, banks, like Bank of America and Citibank, can be thought of as balance sheet lenders, whereas mutual fund companies, like Vanguard and Fidelity, are fund managers. From the FAO table, Oikocredit and AgDevCo can be considered balance sheet lenders.

For-profit versus not-for-profit versus cooperative

There is another interesting difference between fund managers and balance sheet lenders. Fund managers, like Phatisa and Incofin, are typically privately owned and for-profit. Any profit they make goes to the shareholders of the fund manager. Neither AgDevCo or Oikocredit are structured as for-profit. AgDevCo is structured as a “not-for-profit distribution organization” in the UK, so any profit is reinvested rather than distributed to shareholders. Oikocredit was established “to provide churches and others with an alternative investment instrument, directed at the interests of the poor” and is structured as a cooperative in the Netherlands.

Government support

Some of the funds have development finance institutions (DFIs) as investors. Examples of bilateral DFIs (established by one country) are the U.S. International Development Finance Corporation (DFC) and KfW Development Bank (Germany). The African Development Bank is an example of a multilateral DFI (established by multiple countries).

The Foreign, Commonwealth & Development Office (FCDO), an investor in AgDevCo, is an interesting case. The AgDevCo investment was originally made by the UK Department for International Development (DFID). Later, DFID was merged with the Foreign and Commonwealth Office to create FCDO. From my understanding, that would be the equivalent in the U.S. of USAID (DFID counterpart) merging with the U.S. Department of State (Foreign and Commonwealth Office counterpart).

Some final comments

-

Agribusiness funds are focused on large companies, not agri-SMEs, and are typically equity. They do a smaller number of larger deals and target higher returns in the teens (e.g., African Agriculture Fund (AAF) targeted a 17% internal rate of return (IRR)).

-

The agribusiness funds, which are focused on agri-SMEs, have more concessional investors, like foundations.

-

The first two examples were closed-end equity funds, which mean they have a finite life, often 10 years (i.e., they are likely no longer actively investing). The last three are open-ended (primarily) debt structures.

Drafted by Songbae Lee, Agriculture Finance Team Lead at USAID.

This article was originally posted by Agrilinks.