Photo: Feed the Future / Likati Thomas

In parts 1-3, we talked about smallholder farmers. Now we’ll shift our discussion to small businesses, or as referred to in the development sector, small and medium-sized enterprises (SMEs). Some highlights:

-

A finance activity’s connection to smallholders can be long (indirect) or short (direct).

-

Transaction size is a good proxy for defining SMEs.

-

You need to understand unit economics to understand if something can scale.

When is a finance activity a smallholder finance activity and when is it an SME activity? One Acre Fund is clearly a smallholder activity. It is an organization that works directly with smallholder farmers. Aceli Africa, a market-based incentive facility that USAID supports, is clearly an SME activity. It provides incentives to funds and banks that lend to SMEs that meet minimum “positive impact criteria,” e.g., sources from at least 25 smallholder farmers. How about the case of the Farmfit Fund, a blended finance activity that USAID also supports? On its website, it describes itself as “the world’s biggest ever public-private impact fund for smallholder farmers.” It is true that its goal is to help smallholder farmers, but it does not make loans directly to smallholder farmers. The businesses that it does make loans to are much larger than the ones that Aceli targets. The point is that you sometimes need to dig a little beneath the surface to understand exactly what an activity does.

Some SME definitions

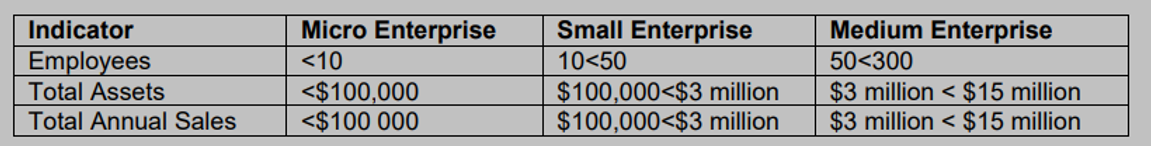

How should we define an SME? One of the most common definitions used from the International Finance Corporation (IFC) is based on number of employees, total assets and/or revenue. A company must meet two of the three criteria below:

While this makes sense in principle, in practice it's challenging to collect this type of information. The employee definition doesn't apply well to cooperatives or other agri-SMEs that might have fewer than 50 employees but purchase from several hundred or several thousand farmers. That is why the IFC uses transaction size as a proxy:

This is definitely my preference and the approach Aceli Africa uses to define SMEs, i.e. those with borrowing needs from $25,000 to $1.5 million. ISF Advisors similarly uses a range of $50,000 to $2 million.

Debt or equity?

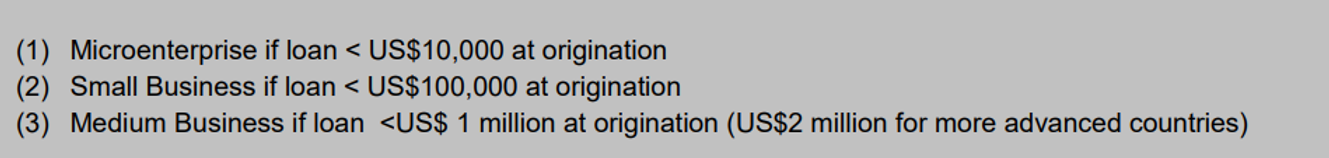

One other thing I'll note is that the IFC transaction size specifically references loans. I think this is important because in my mind it acknowledges that most SMEs in developing markets are looking for debt rather than equity. Most people are familiar with the stock market but not the debt market. I think this makes them not realize how important debt, i.e. credit markets, are. In 2020, companies globally raised $27.3 trillion in debt (long-term bond issuance) and $826.8 billion in equity, meaning that only 3% of the total capital they raised was equity.

Capital Markets Fact Book, 2021 – SIFMA

The missing middle

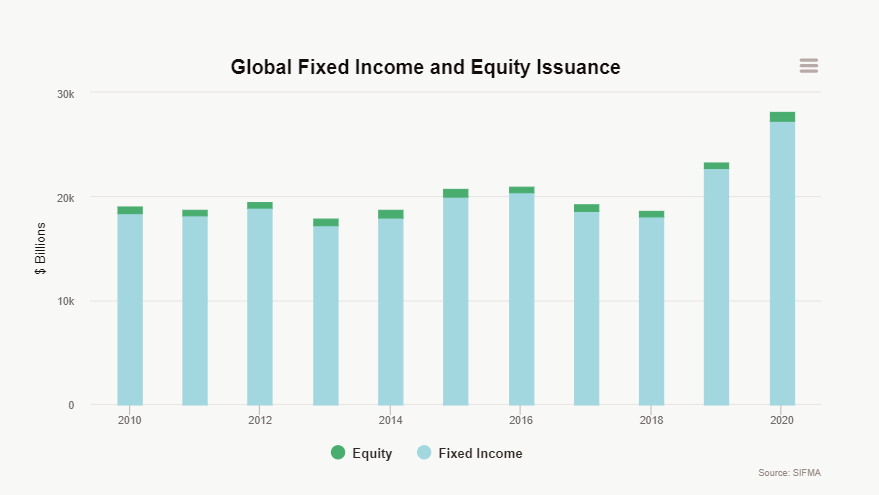

Another way we define an SME loan is by what it is not. It is too large to be a microfinance loan but usually not large enough to be a commercial bank loan. That is why SME lending is often called the missing middle. The missing middle is considered something specific to developing economies.

Small Enterprise Impact Investing, Symbiotics, 2013

In the United States, we typically call SMEs small businesses. The Small Business Administration (SBA) classifies a small businesses based on its industry, e.g. a construction company can have revenues of $40 million per year and still be considered small while a soybean farm has to have revenue of less than $1 million to qualify. The average small business loan in the United States in 2018 was around $700,000 while an SBA 7(a) loan was around $400,000. Some believe that the existence of the SBA and other government programs (e.g., the Community Development Financial Institutions Fund) that stimulate private sector lending explains why there's much less of a missing middle in the United States.

Not only do we have different measures of what defines an SME loan, we have the additional challenge of comparing different finance activities because they combine different size segments. See below for some examples of USAID finance activities.

It would be great if we could agree to some standard definitions for these different size categories, and then each activity could make adjustments to those definitions to suit its specific context. Again, I would stick with something more simple and practical such as transaction size and whether it’s debt or equity.

Lending economics

How different are the lending economics in microfinance versus agri-SMEs?

NKG SLF is the Smallholder Livelihoods Facility, an initiative of the Neumann Kaffee Gruppe (NKG). There are good resources available in this Symbiotics report co-written with the Consultative Group to Assist the Poor (CGAP) and in this joint report from Dalberg and Aceli Africa, but to create a more simple comparative table, I made up my own estimates.

It is already a stretch for me to make these generalized estimates but I think they have directional value. Not only do we need this level of detail, but we also need a reference point to better understand the challenges we’re facing. I hope one day to include estimates of smallholder lending economics in the table as well.

Drafted by Songbae Lee, Agriculture Finance Team Lead at USAID.

This article was originally published by Agrilinks.