As emphasized in CGAP’s Leadership Essay on resilience, low-income communities in emerging markets and developing economies (EMDEs) are hit the hardest by climate-related disasters and environmental impacts. They will need a variety of financial services to adapt and grow more resilient to climate change. Are they getting them?

In order to get an approximate sense of the state of this market, CGAP’s initiative on Climate Resilience and Adaptation through Financial Services conducted a quick scan of the existing landscape of climate-responsive financial products offered to vulnerable populations across EMDEs.* We define climate-responsive as those retail financial products that are designed and/or marketed specifically to support vulnerable people to adapt to and/or build resilience to climate risks. The scan identified and categorized over 100 products across various categories, including insurance, savings, credit, and payments.

Photo: UN Photo/Sebastian Rich

The purpose of this study was to:

-

Identify all climate-responsive financial products we could find through desk research;

-

Define a tentative taxonomy of these products;

-

Map the identified products against this taxonomy; and

-

Draw initial conclusions about the state of this market.

While this was only a quick, exploratory effort that came with many limitations and was mostly undertaken as an internal exercise, it did yield a few findings that can contribute to the conversation and future research on the intersection of climate adaptation and financial inclusion. The study also includes findings on climate-supportive products. While generic in design, they are also critical in strengthening climate resilience and adaptation. More information on these products can be found in the deck.

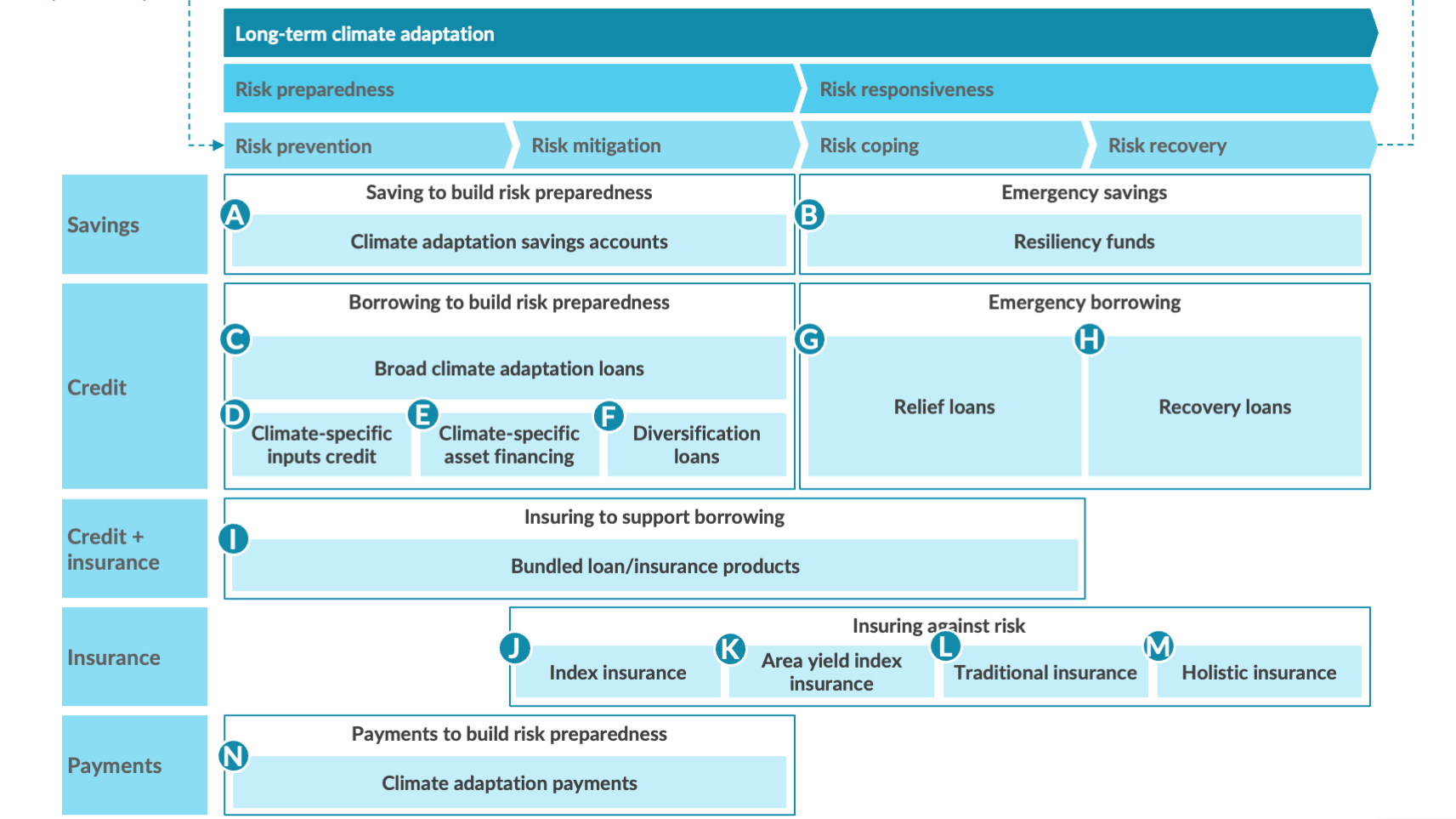

Our taxonomy

The climate-responsive financial product landscape can be broken down into fourteen broad categories, organized on the one hand along traditional product lines and on the other along risk management stages (see fig. below). Some of these are geared toward preparation by reducing the likelihood and potential consequences of climate risk, while others are geared more toward crisis response through coping and recovery. For more details on each category along with examples of each, see the slide deck published alongside this blog.

Photo: CGAP

Figure 1: A proposed taxonomy of climate-responsive financial services

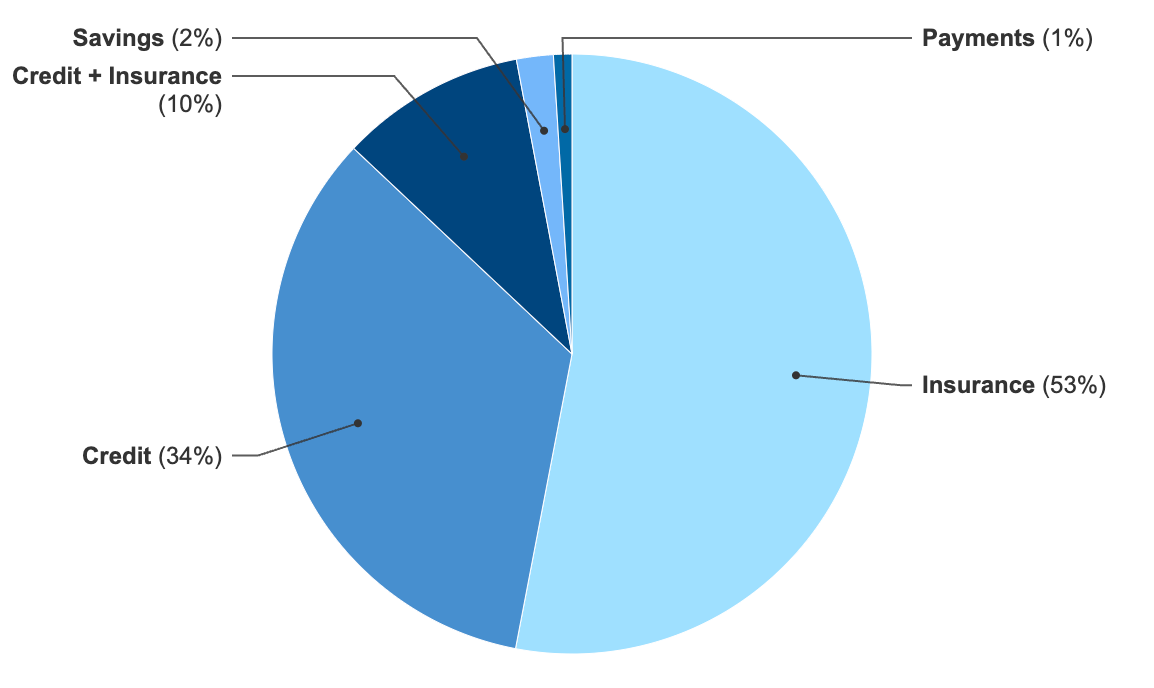

The climate-responsive product landscape centers heavily on insurance

A majority (53%) of all climate-responsive products identified are standalone insurance products, in particular index insurance which represents a full third of the sample and constitutes the single largest product category. Another third (34%) of the sample is made up of lending products, including broad (non-specified) adaptation loans as well as lending for more specific activities (e.g., use of inputs, asset financing, diversification, etc.). Another 10% of the sample consists of products that bundle credit and insurance components in some way.

This finding is noteworthy, given the continued challenge in gaining widespread uptake of standalone insurance products among low-income communities in EMDEs. Put simply, it is hard to get customers in these communities to buy insurance—and yet our scan seems to indicate that it is the main product on offer by FSPs. This potential mismatch between supply and demand raises questions about whether customers are getting the financial products and services that they want. For those of use working on financial inclusion, further research into this seems warranted.

Photo: CGAP

There is a large focus on rural communities and agricultural livelihoods, but virtually nothing aimed at urban concerns

The vast majority (70%) of identified products have an explicit focus on rural communities and agricultural livelihoods, with the remainder being generic. Our scan did not identify a single product that specifically targets urban communities. This is noteworthy since the impact of climate change can play out quite differently in an urban context than a rural one, not least when urban livelihoods are taken into account. Urban populations may need different resilience strategies and different financial solutions for some climate risks—and yet, we find nothing. With half the world’s population living in cities, this also warrants further study.

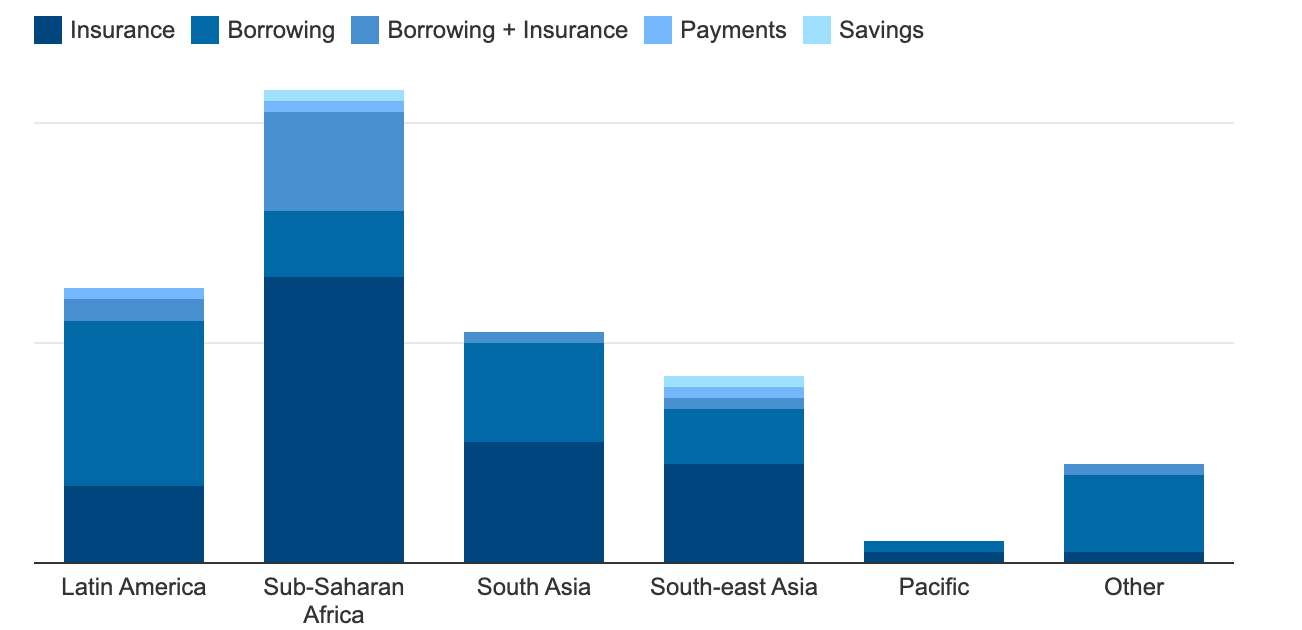

Climate-responsive financial services: Regional breakdown

Photo: CGAP

Savings and payment products play a vital role, yet gaps exist

Savings and remittances typically constitute the first lines of defense for low-income people in dealing with crisis; climate shocks are no exception. This is particularly true for women, who tend to rely more on their savings as a source of emergency funds, compared to men. And yet, our scan identified only two climate-responsive savings products and a single payment product. This may be simply because people tend to use generic savings and payments products, not climate-specific ones—which makes sense. But it begs the question: Do we think generic products are adequate in meeting the climate needs of their clients? Do they need to be tailored to function effectively in times of climate crisis or are climate-specific products needed? There may be a need to explore whether and how they can be improved to yield better outcomes.

Gender is an afterthought

Gender is not a strong consideration in current climate-responsive product design. Evidence shows that women in low and middle-income countries (LMICs) are at higher risk of loss and damage from the impact of climate change than men, due to underlying inequality factors associated with gender. And yet, 80% of products in our scan don’t make explicit reference to female users. We found only a single product that had explicit gender intentionality in design. Hence the nexus of financial inclusion, climate change, and gender is one that is yet to be further explored.

Considering all this, what’s next?

For all its limitations, our scan traced a clear outline of the climate-responsive product landscape and surfaced several questions that deserve probing further. Clearly, there is still much to be explored regarding products that incorporate climate resilience and adaptation into their design. This is particularly true for savings and payment products, and for an overall stronger consideration of gender that integrates gendered impact in the context of climate change and financial inclusion.

*This was an initial, rapid exploration of the space which was limited in various ways that should be noted when considering the findings. Most notably, the scan was undertaken in English and hence did not identify products marketed only in other languages. Particular attention was paid to Nigeria and Bangladesh, which are priority countries for CGAP project undertaking the research. It is also important to note that many financial products may support vulnerable people’s climate adaptation and resilience strategies without being explicitly marketed around climate change; such products that are more generally climate-supportive were however not the focus of this scan.

This article was originally published by CGAP.