Written by Peter Zetterli and Alexander Sotiriou of CGAP

©CGAP/Sudipto Das

Many in the global financial inclusion community are concerned about the impact that COVID-19 is having on microfinance institutions (MFIs) and their clients. In CGAP’s conversations with stakeholders over the last several months, we have repeatedly heard the following questions:

-

How is portfolio quality being impacted by COVID-19?

-

Are MFIs facing a liquidity crisis?

-

Is the solvency of institutions at risk?

-

What is the outlook on the sector among MFIs?

So far, nobody has had the data to answer these questions from a global perspective. The biweekly CGAP Global Pulse Survey of MFIs was created to fill that gap and attempt to provide some answers. With the survey now live for two weeks, data are still coming in from MFIs around the world, and we are only beginning to analyze the findings. That said, we can start to see the outlines of some answers.

How representative of the sector is the survey?

Before getting into the findings, it is worth noting the limitations of the data. Firstly, with 180 MFIs reporting, this is still a relatively small share of the sector. Second, there may be selection bias in who has responded. Third, the data are self-reported and have not been validated, beyond basic consistency checks. As the survey continues with additional waves, we hope to expand the sample with more MFIs. We would ask for your help in that regard by encouraging MFIs in your networks to sign up and complete the survey here.

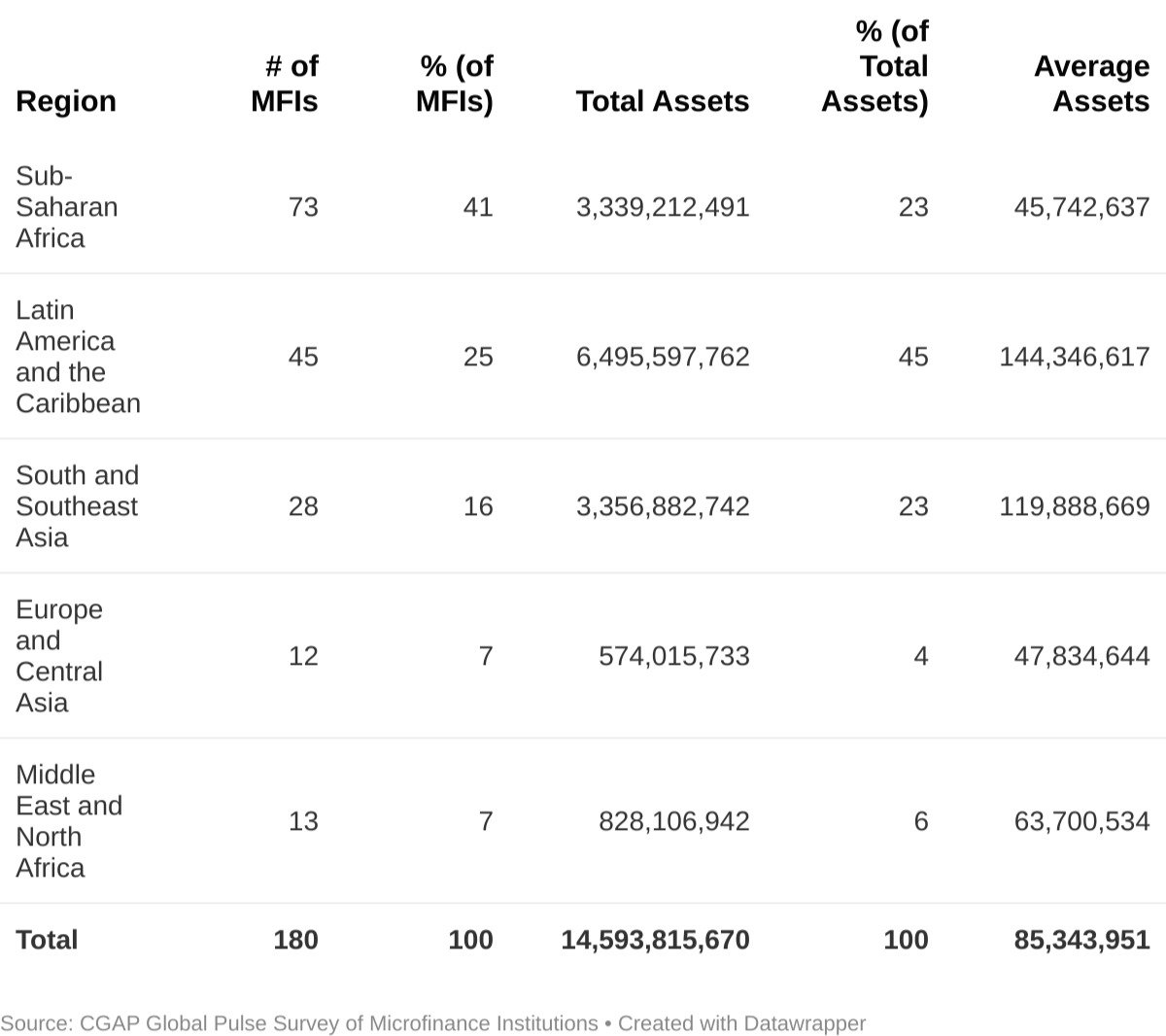

So let’s start with a few points about our sample. One hundred and eighty MFIs responded to the first wave of our survey, conducted June 1 – 15, 2020. Most are from Sub-Saharan Africa (41 percent) and Latin America and the Caribbean (25 percent). In total, participating MFIs have about $14.59 billion in assets, for an average asset size of about $85.3 million. Most (39 percent) are medium-sized firms with between $10-100 million in assets, followed by smaller (37 percent) and larger institutions (17 percent). Survey respondents were also much more likely to be regulated (80 percent) than not.

Survey Respondents by Asset Size

All amounts in USD

How is COVID-19 impacting portfolio quality?

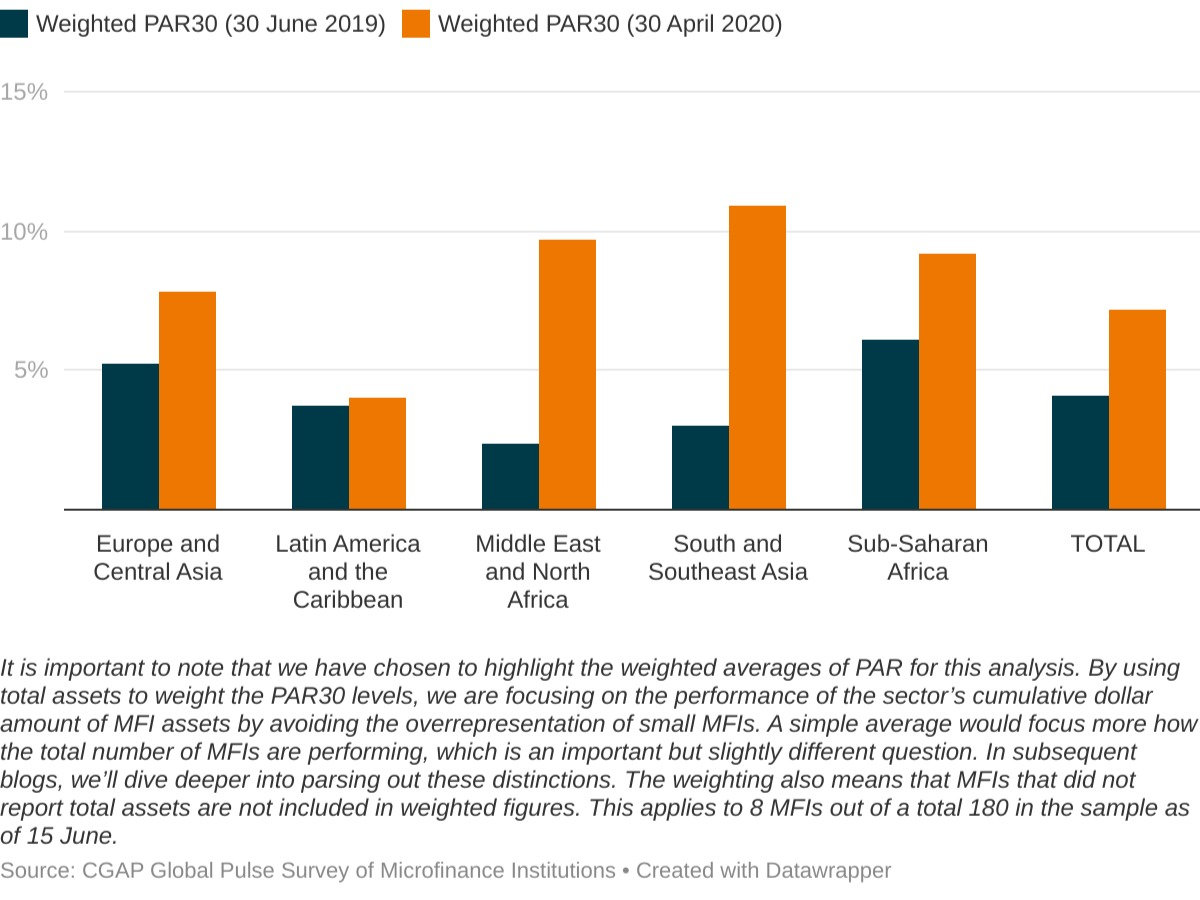

Change in portfolio at risk over 30 days (PAR30). The global average PAR30 rose from 4.1 percent in July 2019 to 7.2 percent in April 2020 among our survey respondents. This 78 percent increase highlights the challenge facing the industry, but it is still less than what many investors and other stakeholders have feared. That said, some parts of the sector are being more adversely affected. PAR30 rates have grown fastest and reached the highest levels among respondents in the Middle East and North Africa (MENA) region as well as South and Southeast Asia (though it is worth noting that the MENA sample so far consists of only 13 MFIs). Note that we have highlighted weighted averages of portfolio quality metrics for the reasons detailed in the chart below.

PAR30 Before/After COVID-19

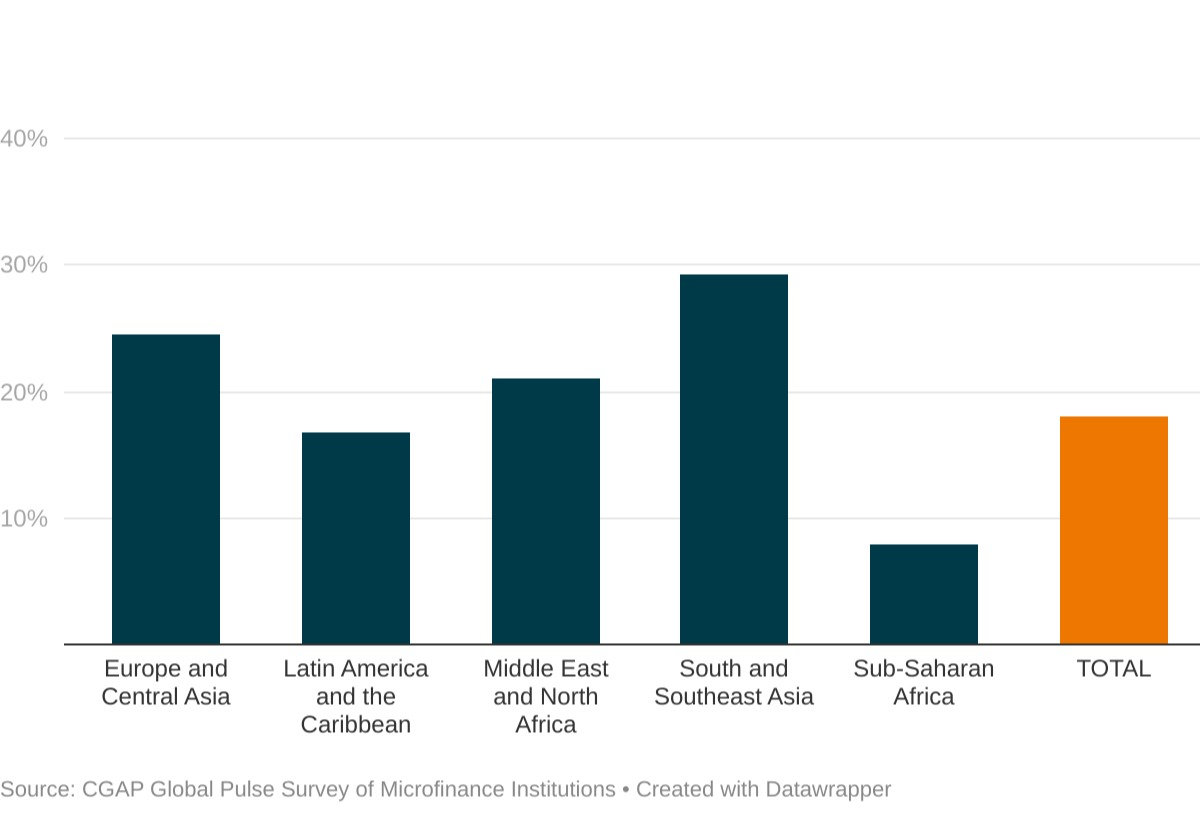

Portfolio restructuring (including portfolio under moratorium). To understand how COVID-19 is impacting portfolio quality, it is essential to see the degree to which MFIs are restructuring and writing-off their portfolios; both of these actions improve PAR30. On average, participating MFIs report that 18.1 percent of their portfolios have been restructured or are under moratorium, as of April 2020. South and Southeast Asian MFIs have the highest levels and those in Sub-Saharan Africa have the lowest. These are high rates by historic standards and are likely due to the mandatory repayment moratoria that some governments have imposed, as well as the proactive decisions of MFIs to adapt to the changing circumstances of their clients.

Percentage of Portfolio Restructured or Under Moratorium

Weighted by total assets, as of April 2020

Are MFIs facing a liquidity crisis?

Discussions on the nature of the current crisis often focus on the concern that MFIs may find themselves without enough cash to cover their operating expenses and service their debts. Our data do not support the hypothesis that liquidity is an urgent concern, at least not as of the end of April 2020. This could have any number of reasons: liquidity support already being provided by funders, lower lending, or reductions in operational expenditures. Whatever the reason, the average MFI in our sample has enough cash and liquid assets to cover seven quarters of operational expenses. This does not seem to vary significantly across regions; however, MFIs from Europe and Central Asia as well as Sub-Saharan Africa report slightly lower cash reserves, while those in Latin America and the Caribbean report slightly higher.

These higher liquidity levels could be good news — but not necessarily. An MFI can temporarily shore up its liquidity by halting lending operations and laying off staff while continuing to collect repayments where possible. These are common actions for any lender that is anticipating a crisis and could be seen as a rational and financially prudent approach. But this strategy risks pushing the liquidity crunch onto the people who are least able to absorb it: low-income clients. And in the long run, these actions could reduce the portfolio size and the operational footprints of MFIs to unsustainable levels, potentially leading to a solvency crisis.

We are digging deeper into the liquidity questions and will have more analysis to share on this soon.

Is the solvency of institutions at risk?

While the increase in PAR30 is concerning, it looks — at least, as of April 2020— unlikely to spark an industry-wide solvency crisis. However, solvency could become a greater concern if these figures continue to rise.

The real question is this: What is going to happen with restructured portfolios? Our respondents report that 18.1 percent of their portfolios have been restructured or are in moratorium. If one third of that debt turned bad, the average PAR we are reporting here would nearly double from 7 to 13 percent. On the extreme ends, one can imagine two very different scenarios in which those figures could evolve:

-

In an optimistic scenario, there is a relatively rapid recovery among clients, and MFIs end up collecting 80 percent of their restructured portfolio (albeit with some delay). Writing off the remaining 20 percent would result in significant losses, but it would be unlikely to pose an existential threat given the relatively high capitalization levels in the sector.

-

In a pessimistic scenario, the current crisis has a longer-term impact on the finances of clients, and MFIs collect just 20 percent of their restructured portfolios. This would be more likely to spark solvency risks, especially among the most vulnerable institutions and in the most affected geographies.

Which scenario is most likely to play out? We simply do not know, and the answer will surely vary by region, MFI type and other factors. And like so many things in our world today, the fate of MFIs will depend on how the COVID-19 scourge plays out, on the policy responses taken by governments and regulators, and on the actions taken by the investors and lenders supporting the sector.

What is the outlook for the sector among MFIs?

Our survey asks MFIs: “How badly would you say the microfinance sector in your country is struggling right now?” Respondents answer on a scale ranging from (1) “business as usual” through (5) “severe stress” and up to (10) looming disaster (10). In Wave 1 of the pulse survey, the average score was 6.4 — clearly beyond “severe stress” but not in the most alarming territory. This metric was also very consistent across regions, with the exception of Europe and Central Asia which averaged a slightly lower 5.3.

Our sense is that this figure tallies well with the other findings in the survey. MFIs are under significant pressure and have already taken extraordinary measures to preserve portfolio quality. Their underlying fundamentals are arguably still sound, and their worst fears have not been realized; however, there is still great uncertainty about the how quickly things will return to normal and how normal they will be.

We will continue to track this simple metric frequently, as a rapid leading indicator of the state of the industry in different regions and different parts of the sector.

What’s next for the CGAP Pulse Survey?

These are just preliminary highlights from the first wave of the survey. We will be deploying short waves on a biweekly basis for the next 3 to 6 months to track several core metrics and collect information to deepen and refine our analysis. As we have more time to analyze, digest and discuss the data, we will publish additional findings.

Over the next few weeks, we will be blogging about a few key topics:

-

Liquidity, along the lines of the widely read piece by Daniel Rozas using 2016 data from MIX Market

-

Solvency, sketching out the scenarios described above in more detail

-

Granularity, delving into the differentiated impacts across regions, MFI types, and other factors

In the meantime, we invite you to conduct your own analysis using our public dashboard hosted by ATLAS.

Lastly, we would like to conclude this with a giant thank you to all of the MFIs who have participated in our survey so far. We are encouraging all MFIs to participate. We are all in this together and the more information we are able to share, the better position we will be in to survive this crisis and come out of the other end with a stronger, more resilient MFI ecosystem.

The CGAP Global Pulse Survey of Microfinance Institutions is a global effort that depends on the participation of MFIs around the world. To learn more and sign up to participate in the survey, please visit www.cgap.org/pulse. This is the first post in the blog series “Microfinance and COVID-19: Insights from CGAP's Global Pulse Survey.” We will regularly share our latest analysis of the survey data in this blog series.

This article was originally published by CGAP.