The agricultural sector employs over two-thirds of the African labour force and serves as their main source of income. It significantly contributes to the agricultural GDP, yet less than 5% of net bank funding in most nations is allocated to agriculture. In Sub-Saharan Africa (SSA), the demand for loans by Agricultural Small and Medium Enterprises (Agri-SMEs) is approximately USD 90 billion and about 83% of the required funds are unmet annually. Agri-SMEs particularly businesses seeking loan amounts of $500,000 or less, struggle to access funding because lenders generally find the economics of larger loan disbursements more suitable.

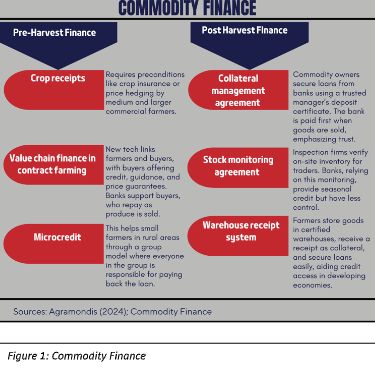

In addition, agri-SMEs in developing nations are often limited by interest rates and high collateral. While farmland, equipment, and agricultural commodities can be used as collateral, they have their challenges. Farmland collateral is limited by its lack of market, and farm equipment is limited by the lack of secondary markets for equipment in the event of repayment failure. The most used collateral is the commodity collateral which can be pre-harvest or post-harvest finance.

Agricultural financing in Africa faces certain challenges but also presents opportunities. By supporting agricultural SMEs, we can help bridge the employment gap and enhance food security. In this context, we will examine the trends, challenges, and opportunities that have influenced the landscape of agricultural financing in Africa, as well as emerging ones.

Challenges

In contrast to the sector’s 20–40% GDP contribution across the continent, commercial bank lending to agriculture in Africa only varies across the continent. This spans from 3% in Sierra Leone, 4% in Ghana and Kenya, 6% in Uganda, 8% in Mozambique, and 12% in Tanzania, according to the Making Finance Work for Africa initiative. The agriculture industry receives barely 5% of total domestic resources on average.

Agri-SMEs face a critical hurdle to growth due to limited access to financing caused by lender risk perception, high-interest rates, and collateral challenges. Agri-SMEs are challenged by price fluctuations, high-interest rates as high as 47%, political instability, and the threats of climate change. Unfortunately, the perception of high risk by lenders has resulted in agri-SMEs being excluded from essential financing, threatening the livelihoods of millions of smallholder farmers. This has hindered farmers and businesses from accessing loans and also posed a significant barrier to the growth of the sector.

The financial needs of farmers and agricultural SMEs are not adequately met by either commercial banks or the microfinance sector. Many financial service providers have refrained from offering their services, due to the perception of high risk and low returns, as well as the expenses associated with expanding traditional banking infrastructures in rural regions. According to the G-20 Global Partnership for Financial Inclusion (GPFI) SME Finance Sub-Group, farmers and agricultural SMEs are left unserved because neither commercial banks nor the developing microfinance sector is willing or able to adequately meet the financial needs along agricultural value chains.

While financing unlocks potential, agri-SMEs face hurdles like limited rural infrastructure, high service costs for traditional lenders, and a lack of financial literacy among both lenders and farmers. This complex challenge requires innovative solutions.

Opportunities

The current financial landscape presents a tremendous opportunity to close the gap in services for farmers and agri-SMEs, unlocking their full potential for growth and food security. The reluctance of financial institutions to venture into these areas is limiting the economic development of rural communities and the agricultural sector. To address these barriers, some donor-funded initiatives are encouraging financial institutions and are offering loans to agri-SMEs and making borrowing money easier even if they are high risk.

Innovative financing mechanisms such as AGRA’s credit guarantee and risk-sharing facilities can enhance the growth in African Agriculture. Making finance work for Africa (MFWA), highlighted innovative financing mechanismsthat can catalyse growth in the African agriculture sector, of which some have been implemented. For instance, efforts such as AGRA’s credit guarantee and risk-sharing facilities with Equity Bank and Standard Bank in South Africa have leveraged ten times their commitments of risk-sharing public capital into private lending to farmers.

West African countries establish credit guarantee schemes to mitigate risk and boost agricultural lending. Some countries have also established agriculture credit guarantee schemes (e.g. Ghana, Nigeria, and Uganda) housed in their Central Banks. However, the performance of these schemes has been mixed. In Nigeria, an Incentive-based Risk Sharing System for Agricultural Lending owned by the Central Bank of Nigeria deployed its seed capital of USD 500 Million through five pillars (i.e., risk sharing facility, insurance facility, technical assistance facility, bank rating, and bank incentive). The goal is to reduce risk in the ag financing process, develop sustainable capacity, and raise agricultural lending from 1.4% to 7% of total banking lending in Nigeria. From 2017 to 2022, banks’ loans to farmers saw a significant increase of 197%, equating to an annual growth rate of 39.4%. This is slightly below the Central Bank’s target of 40%. Furthermore, in 2022, the proportion of total bank credit allocated to agriculture was 6.16%, falling short of the CBN’s 7% target by 0.84%. There is also the Ghana Incentive-based Risk-sharing System for Agricultural Lending (GIRSAL) which helps SMEs get loans at lower rates with extended terms. It guarantees up to 80% of credit provided by participating banks.

Public and private initiatives address financing gaps for agri-SMEs in Africa. To help developing countries, the International Finance Corporation (IFC), a commercial sector of the World Bank Group is investing a payout of approximately USD 32.8 billion into private enterprises and financial institutions to bolster agricultural development, while USAID’s FASA program and Mastercard Foundation’s RAF LL challenge fund targets agri-SMEs directly with junior capital and incentives to attract private investment. Additionally, the Council of Smallholder Agricultural Finance (CSAF) works to mitigate risk for local lenders, facilitating billions in disbursements to agri-businesses across Africa. A strong relationship between Ag-Tech and financial institutions can improve financial accessibility. However, the limited enabling environment in most developing countriesoften restricts the potential for increased access provision.

Trends

Agricultural finance is essential for promoting agricultural productivity, food security, and rural development in Africa. To understand the effectiveness and impact of ag financing, the various trends explain the development level in Africa.

The use of standardized bankability metrics can help agri-SMEs and their supporting service providers understand lenders’ expectations, enabling them to prepare for assessments and respond to information requests more efficiently. Standardization aids agri-SMEs in improving recordkeeping and business practices, enhancing credit chances. Similar strategies have worked in sectors like climate finance. IFAD suggested a common definition and reporting method. CFI and SCOPEinsight developed bankability metrics for agri-SMEs and lenders, aiding pre-due diligence information sharing and capital flow. These metrics don’t dictate credit decisions due to varying lender risk appetites. In 2020, a project in Ethiopia, in collaboration with the IFC and Heineken used SCOPEinsight’s standard assessment tools to detect and fortify weaknesses tools to strengthen 39 agribusinesses, 23 farmers, and 14 unions. This led to USD 1.8 million in short-term financing for 29,000 farmers with almost no defaults.

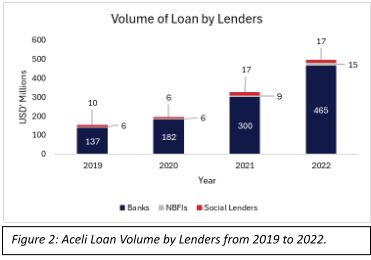

The total annual financing disbursed to agri-SMEs in SSA is slowly but consistently chipping at the USD 90 billion gap in ag financing. Since 2013, there has been an upward trend in the total amount of financing received by agri-SMEs in SSA. The 2024 Financial Benchmarking Report by Aceli indicates that between 2019 and 2022, agri-SMEs in East Africa received loans totalling approximately USD 1.2 billion. These loans were provided by a combination of 35 lenders, including commercial banks (USD 1.08 billion), nonbank financial institutions (NBFIs) (USD 36 million), and international social lenders (USD 50 million). This indicates a consistent growth in the amount of funds allocated to agribusiness over the four years.

Meanwhile, there is a rising emphasis on food crop value chains throughout the region. Social lenders and non-bank financial institutions cover gaps left by commercial banks by providing services such as unsecured loans, factoring, and equipment leasing using conservative methods due to COVID-19. African government funding for the agricultural sector has shown a positive trend in recent years. This is evidenced by a significant increase in budgetary allocations, with funding reaching USD 16.2 billion in 2018 compared to USD 6.4 billion in 2000. The proportion of total budgetary resources directed towards agriculture has also grown slightly, rising from 3.9% in 2000 to 4.3% in 2019.

Financing agri-SMEs is a catalyst for growth, empowering women and boosting productivity. One case study is the Aceli initiative which supported Nyamurinda, a Rwandan coffee trader that was struggling to grow despite directly supplying buyers in Europe. Without access to credit with reasonable interest rates and collateral requirements, the female-founded company had to pay farmers high prices. After a USD 100,000 credit line, the business expanded, sourcing from 1,400+ farmers, growing sales by 60%, and adding buyers. It now supports farmers with seedlings, inputs, and training. This financial access boosts revenues and improves farmers’ conditions. Farm Funds Africa is an organization that offers low-interest loans to smallholder farmers and plays a crucial role in enhancing the lives of smallholder farmers in Africa. This contributes positively to food security, poverty alleviation, and economic growth in Africa especially in Ghana, Nigeria, and Kenya.

The access and outreach of agriculture financing has decreased between 2020 and 2024 due to COVID-19. Aceli’s lending partners provided incentives for double the number of loans, attracting new lenders. 33% of the loans went to new borrowers. Tanzania performed well with 56% of loans going to new borrowers. Aceli-supported loans encourage capital addition, with 62% going to new borrowers. Aceli partnered with Value for Women to design customized strategies and financial products for women entrepreneurs. Family Bank in Kenya increased financing for women-owned agri-SMEs from three in 2021 to 24 by 2023.

Average loan size fell short of projections between 2020 and 2023. The projected average of Aceli Africa was USD 476,000, but the actual average was USD 118,000 for 2020-2022 and USD 90,000 in 2023 (around a quarter of the initial projection). This significant decrease is attributed to a nearly 3.5-fold increase in the number of loans and lenders served. To meet the financial needs of a wider range of agri-SMEs in East and Southern Africa, the average loan size is expected to remain around USD 91,000 until 2025. Furthermore, in Nigeria, efforts are being made to finance Agri-SMEs. However, these initiatives have yet to fully bridge the financing gap.

There is the provision of support to increase the accessibility of Agri-SME loans by offering a considerably low-interest rate. The Ideal Sustainable Finance (ISF) identified a need for 130,000 SMEs in SSA to access financing. The Tanzanian government initiated a fund totalling Tanzanian Shilling (TZS) 1 trillion, approximately equivalent to $435 million at the time, to be disbursed through financial institutions for agricultural lending purposes. Banks accessing these funds are charged an annual interest rate of 3% in TZS and are obligated to extend loans to the market at rates not exceeding 10% in TZS. Participating banks benefit from reduced minimum reserve requirements, enabling them to allocate more capital within the market.

Donors are incentivizing agricultural lending by disbursing loans to Agri-SMEs through local financial partners. Between 2020 and 2022, the Aceli initiative supported local financial partners with incentives for 713 loans valued at USD 84 million. Interestingly, during this period, loan disbursements in Kenya and Tanzania, grew in the USD10 to USD50,000 segment as opposed to larger segments. Uganda has the highest number of participating lenders, allocated 12% of bank lending to Agriculture as compared to Tanzania (8%), Kenya (3-5%), and Rwanda (3-5%). As a result of Aceli’s origination incentives, some lenders are offering borrowers more attractive loan terms, such as collateral and pricing adjustments, longer terms, and lower minimum loan sizes.

Lenders exclusively support agricultural businesses, including farmers’ cooperatives and private companies with a revenue range between $250,000 to over $10 million. These businesses play a crucial role in assisting smallholder farmers by purchasing their produce and facilitating connections to domestic and global markets. For instance, a cooperative called Sol and Café aimed to access higher prices in the global market and was financed by a CSAF partner, which significantly contributed to steady market growth. Additionally, through this initiative, farming communities have been empowered with various opportunities, including employment, access to finance, and additional benefits such as education, healthcare, and clean water.

Conclusion

Agri-SMEs are vital to Africa’s agriculture, but their growth is hindered by limited financing. Despite their significant contribution to GDP and employment, they face an annual funding shortfall of about USD 90 billion due to lenders’ risk perception, high-interest rates, and collateral issues. Innovative solutions like credit guarantee schemes, donor-funded Programs, standardized bankability metrics, gender-focused financing, and diverse collateral options are emerging to bridge this gap and unlock agri-SMEs’ potential. The recent rise in financing for African agri-SMEs is encouraging. However, the impact of the COVID-19 pandemic on outreach and the shortfall in average loan size underscores the need for efforts. Promoting collaboration between governments, financial institutions, and development organizations could lead to a more inclusive and sustainable financial system for agriculture in Africa. This will empower agri-SMEs, enhance productivity, and contribute to food security and economic growth across Africa.

This article was initially published by Agramondis.