Photo: ISF

Women play a central role in rural economies, primarily through the agricultural sector. Yet these women face many barriers, including time poverty, lack of land ownership, fewer agricultural inputs, restrictive social norms, and less access to finance. The emergence of digital agricultural platforms has the potential to help rural women overcome these barriers and improve their livelihoods.

Digital agriculture platforms are a specific subset of AgTechs, defined as models that facilitate direct interactions between multiple users for the purpose of exchange. These platforms are built upon network effects—enabling multiple users on both sides of an exchange to interact, creating shared value for both platform providers and end users. The unique benefits created by digital platforms could be particularly helpful in leveling the playing field for women; however, platforms currently struggle to reach and engage this important customer segment.

In new research from CGAP, ISF Advisors and Value for Women, we look at how digital agricultural platforms can best integrate gender-forward practices, what the major opportunity areas are for creating shared value, and how donors and investors can support these efforts. This research builds on CGAP’s extensive work surrounding women in rural and agricultural livelihoods (WIRAL). In this blog post we summarize a few key findings, with a deeper dive into the opportunities surrounding sex-disaggregated data.

Understanding how digital platforms currently think about gender

Digital platforms have the ability to disintermediate markets, connect multiple users, facilitate information sharing, and provide farmers with a digital financial footprint. These benefits could be especially useful for rural women in overcoming gender-related barriers. For example, the exchange of knowledge and information that are crucial to competitively participate in markets (e.g., prices) is often out of reach for women due to restricted mobility and social norms that keep them out of male-dominated spaces. Digital platforms could connect them to this vital information with far less friction.

Unfortunately, although the digital platform market has grown rapidly, these AgTechs are struggling to reach rural women. While women make up half of smallholder farmers in sub-Saharan Africa, they represent only 25% of AgTech users. Even when AgTechs do reach rural women, usage rates suggest that they are not sufficiently serving them.

Many platforms recognize this missed opportunity and are thinking more about gender—but are only beginning to translate that into concrete action. While there are some encouraging examples of gender-forward efforts, this area is largely not seen as critical to commercial success. Platforms are generally focused on the short-term challenges of achieving profitability and scale. But platforms that integrate long-term gender intentionality into their models could tap into a large opportunity if they implement the best practices proposed in this research.

What are the best practices and biggest opportunities?

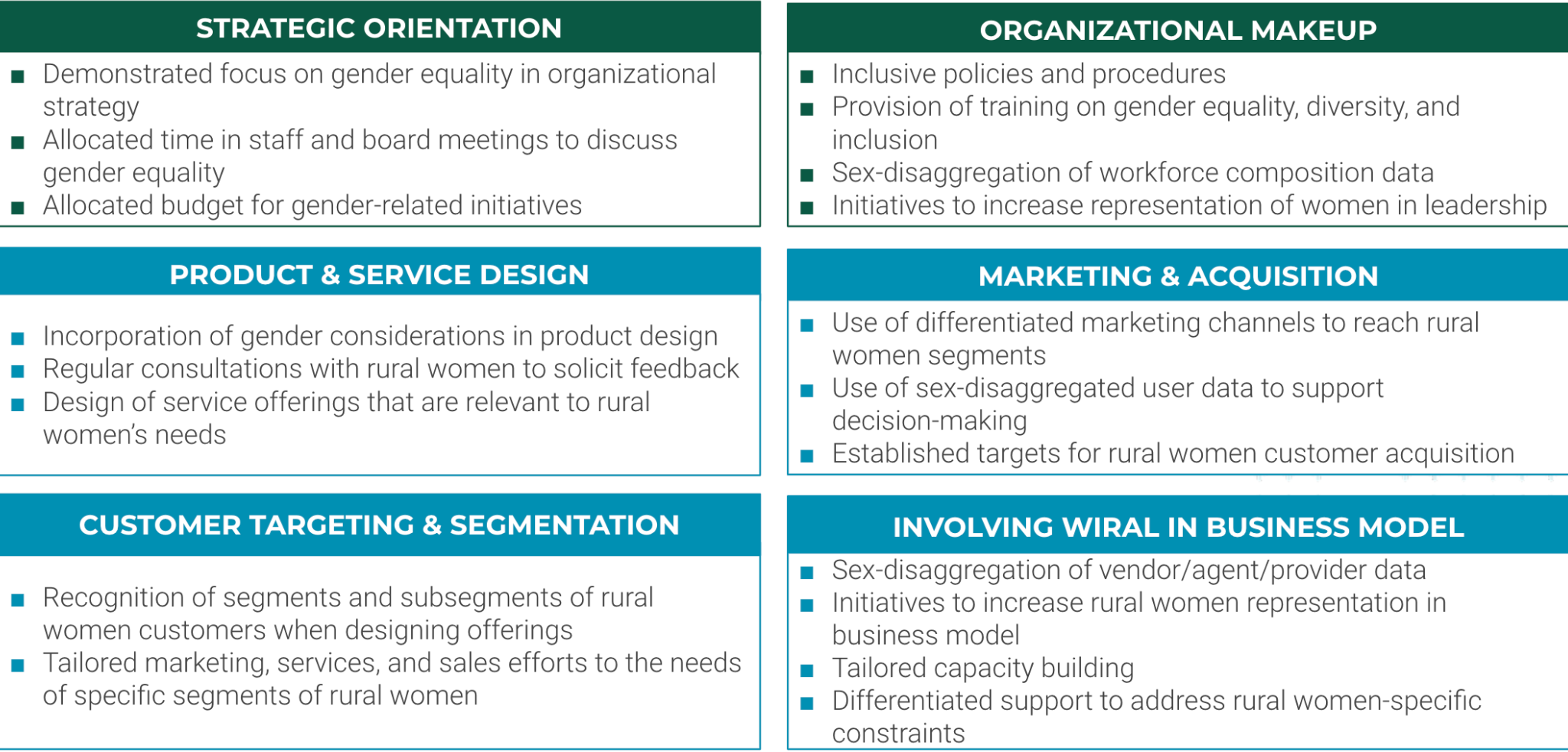

In our research, as seen in the figure below, we lay out a curated list of best practices that platforms, and their investors and donors, can adopt—with the ultimate goal of creating shared value for platforms and the women that engage with them.

Photo: ISF

The two practice areas at the top of this figure serve as foundational best practices that influence a platform’s actions in the other four areas. Internal prioritization of gender in the organizational strategy, budget, policies, etc. is necessary to then enable external-facing best practices around marketing, customer targeting, product design, and providing income generating opportunities.

Building on this, we outline the four biggest opportunities for platforms to increase shared value for themselves and for rural women. As in the best practices, two of these opportunities revolve around establishing a strong internal foundation for platforms to drive commercial and gender outcomes—and ultimately become more gender-forward:

-

Embedding gender into organizational strategy

-

Sex-disaggregated data for better decision making

The other two opportunities center on increasing impact for women as customers and income earners:

-

Experimenting around women-focused innovations

-

Increasing income-generating opportunities for women

In this blog post, we will take a deeper dive into the opportunities around sex-disaggregated data.

Optimizing sex-disaggregated data for decision making

The collection and analysis of sex-disaggregated data is the typical starting point for increasing gender inclusion both within a company and in the external-facing products and services. A comprehensive business strategy that incorporates gender requires the ability to understand how many women a platform is serving, how well it is currently serving them, and the value women are generating.

Nearly all platforms interviewed collect basic sex-disaggregated data on their end users and their workforce, and nearly half of the providers that have agents on their platforms can also sex-disaggregate that data. However, the majority of platforms do not have a structured process for analyzing this data or taking action on those insights. Only one interviewed platform (CoAmana) seems to be collecting and leveraging sex-disaggregated data that enables it to better engage women customers. For others, there is a significant missed opportunity.

Many providers are aware of this opportunity, but 43% in our sample indicated that it is one of their top three challenges. With a more systematic approach to data collection, analysis, and decision making, platforms can leverage data for:

-

Target Setting and Prioritization: In our research, 50% of platforms surveyed indicated that they have made gender a top five priority, but they must link this strategy to concrete initiatives, set targets, and define metrics to track progress.

-

Understanding Customer Patterns: An important (and simple) next step would be to sex-disaggregate existing data—such as customer ratings or satisfaction scores—to understand satisfaction levels for different sub-segments of women (and other users, such as men or youth).

-

Designing Products: Insight on user patterns can then be leveraged in the product design process. This could result in finding ‘quick wins’ (i.e. shifting land requirements from individual names to family names given barriers for women to access land), or more robust product shifts (i.e. designing products specifically for women or youth).

The role of donors and investors

Importantly, platforms that implement this systematic data-driven approach can then quantify and showcase their impact to potential donors and investors. In fact, there are many entry points for donors and investors to influence platforms to become more gender-forward, especially at early stages of the business.

These entry points include:

-

Building the case for gender inclusion through data and analysis;

-

Funding or facilitating technical assistance for platforms that want to become more gender-forward;

-

Providing investment or grant capital to reduce upfront costs and fuel the growth of gender-forward platforms; and

-

Incentivizing the collection of sex-disaggregated data and broader gender-forward actions.

Investor and donor support (and influence) will be crucial for platforms to overcome market barriers and failures that currently prevent them from investing fully in rural women. This article was originally published by ISF.