Business development providers are essential to a supportive agribusiness ecosystem. AGRA is focused on strengthening this ecosystem so that agribusinesses get the finance they need and financiers are able to invest. To create access to finance for SMEs, it is important for the SMEs and financiers to be able to communicate. Standardized metrics like SCOPE tools can create a common language between SMEs and financiers. To promote the private sector growth, AGRA and SCOPEinsight created the Local Expert Network, which allows SCOPEinsight to teach the common language to local BDS providers while AGRA teaches it to local financial institutions.

Image: ScopeInsight

Introduction

AGRA supports SMEs in their inclusive growth and seeks to strengthen the private sector-led ecosystem that supports SMEs in becoming bankable and investable for formal financiers. Although (blended) financial instruments are available, there often remain gaps between the capacity of the SMEs and the risk/return profile acceptable to the financiers. It is, therefore, necessary to work with both SMEs and financiers to make sure that the demand and supply of finance match.

One of the key elements in such match-making is the harmonization and exchange of relevant data between the SME and the financiers; said otherwise, the SMEs and the financiers need to speak the same language when it comes to performance measurement and finance-ability. A common way of harmonizing language is to introduce a rating system that provides a standard manner to assess the performance development of SMEs. This can inform the financiers and support their due diligence process, informing capacity builders on the progress the SME is making following Business Development Services delivery.

Business Development Services in Emerging Markets

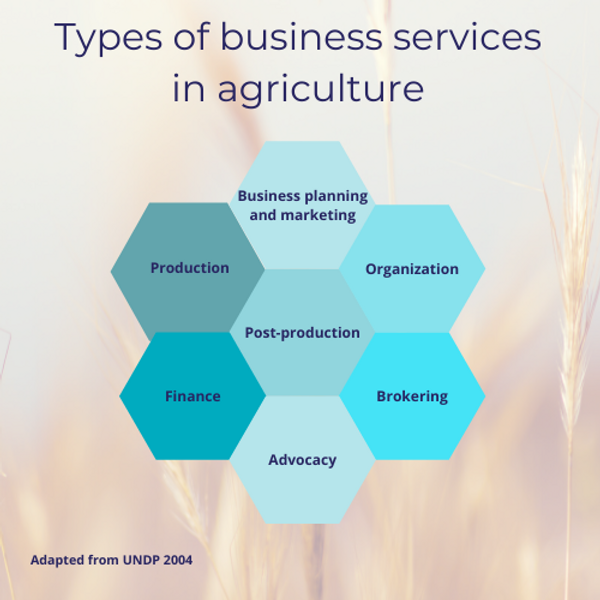

Increasingly, the international development community recognizes the importance of demand-driven business development services (BDS) for agri-SMEs in emerging markets. Long-term, post-project sustainability is more achievable when we facilitate market mechanisms between service supply and demand, reduce market barriers, and improve service provider capacity. In this article, when we refer to BDS services, we refer to the seven distinct services agri-SMEs need to grow and self-sustain. These are: (i) production, (ii) post-production, (iii) business planning and marketing, (iv) organization, (v) finance, (vi) brokering, and (vii) advocacy.

But as development projects began tapping into local BDS providers as a resource, the problems NGOs faced in brokering relationships and access to finance remained for BDS providers. This underscores the challenge of access to finance for agri-SMEs.

Tools and Support to BDS providers

In 2020, the Alliance for a Green Revolution in Africa (AGRA), spearheaded an initiative to give BDS providers the tools they need to broker relationships better and bridge the access to finance gap in five countries (Burkina Faso, Ghana, Mali, Nigeria, and Tanzania). The premise is simple: Have SCOPEinsight onboard the BDS providers to use standard metrics and a common language to help broker relationships. And AGRA will work with financial institutions in these countries to orient them to this common language as a tool to making agricultural finance more affordable and less risky.

This initiative is known as the Local Expert Network. The LEN is a partnership program that provides the tools and support they need. The local experts are the much-needed local infrastructure with the capacity to provide ongoing business development support to agribusinesses well beyond donor-funded initiatives.

A Common Language aligns expectations

In 2019, SCOPEinsight and the Center for Financial Inclusion (CFI), with support from the Alliance for a Green Revolution in Africa (AGRA), embarked on creating a bridge between agri-SMEs and financiers. The team researched over 90 lenders and industry actors and analyzed SCOPEinsight and the Council on Smallholder Agricultural Finance (CSAF) data to understand some of the driving factors behind the significant financing gap.

The research revealed the following:

-

Lenders currently require a large amount of information and spend enormous time and resources to source and assess agri-SMEses’ bankability. Not only does this result in high transaction costs, but the inefficiency results in fewer businesses being screened and leads to larger ticket sizes.

-

Within the eight dimensions of professionalism, three key drivers (i.e.) internal management, market performance, and governance) influence the likelihood of an agri-SMEs receiving a loan.

We also found that the following root problems must be addressed if access to finance becomes a reality for agri-SMEs. Among these are:

-

A professionalization process for agri-SMEs needs to be in place, so agri-SMEs have a roadmap to become more professional (thereby meeting market requirements). By more “professional,” we mean that the agri-SMEs are using systems and processes that are accessible, auditable, and understandable by outsiders like lenders. The prohibitive collateral requirements that many financiers have stemmed from Central Bank regulations and requirements and the lack of any other reliable proof that the agri-SMEs can deploy and repay external funds.

-

A common language (i.e., the Bankability Metrics) makes the interaction between agri-SMEses and banks easier because there is agreement on professionalism defined in indicators/measures. The metrics also offer an alternative risk assessment instead of collateral requirements.

The BDS providers will use the professionalization process for agri-SMEs, namely the SCOPE insight assessment tools (and aligned curriculum) and the Bankability metrics to help create linkages between agri-SMEs and financiers.

Conclusion

Through facilitating market mechanisms between service supply and demand, improving service provider capacity, and stimulating demand, we ensure that a well-functioning service market is in place when donor projects are phased out.

This article was originally published by ScopeInsight.