Photo credits: Cogito

As we celebrate MSME day in late June 2022, crises and uncertainty have become a landmark of the new decade. Just as our economies and societies were on the path to recovery from the deep shock of the COVID-19 pandemic, Russia’s war of aggression against Ukraine is now sending shock waves through the global economy. How will it affect small businesses?

Fading prospects

The 2022 OECD Economic Outlook, released earlier this month, anticipates world growth to be 1.5pp lower this year than projected last December. Average inflation in OECD countries is expected to be more than 4% higher, driven by rising costs of food and energy. These are the overarching economic conditions under which businesses operate – they drive their demand and costs of operation. This is hugely worrying for SMEs who have endured 2 years of the COVID-19 pandemic and are heavily weakened.

According to some early perception surveys, there has already been a marked impact on SME confidence and activity. A third of German SMEs see the Ukraine war as a medium to high risk to their business, particularly in the manufacturing and trade sectors. In Ireland, the Linked Finance SME confidence index fell from 67.9 to 61.1 in the first quarter of 2022. In March and April 2022, small-business sales growth slowed in Australia, New Zealand and the UK to less than half the growth rates seen in March. In Poland – geographically closer to the centre of the crisis – one in five SMEs report being forced to limit their business operations three weeks after the invasion. The same proportion of companies are concerned that they will not survive the crisis.

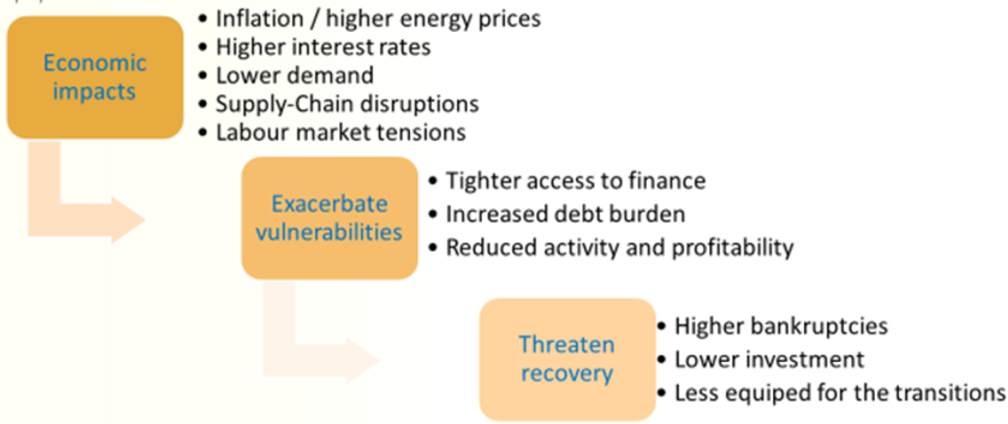

The scheme indicate the price of a troubled business environment

Rising costs…

Rising costs are already beginning to bite. The rise in prices, in particular energy prices, was already the main concern for the business sector before the war in Ukraine. The increase in energy prices and other inputs is particularly challenging for SMEs because of their limited capacity to mitigate the shock. They have less ability to negotiate favourable conditions along their supply chain or with energy providers. They have limited capacity to pass the price increases on to consumers. They are squeezed in the middle.

“There may be a silver lining to the current shock. Current energy prices may incite SMEs to accelerate adoption of energy-efficiency measures.” Celine Kauffmann (OECD)

According to OECD work on No net zero without SMEs, we see that there’s room for action on energy efficiency. SMEs still lag behind large companies in energy efficiency even though most of them have started adopting measures. Beyond cutting costs and improving SME productivity, this would improve their resilience, at least to energy-price shocks. But this will not be automatic and will need to be supported by appropriate policies.

… disruptions to supply chains…

While across OECD counties, direct trade between SMEs and Russia and Ukraine is minimal, some sectors have been badly disrupted. This is the case in agri-food, electronics and chemicals, as well as in logistics where shortages in key components and raw materials, such as potash, or titanium are causing problems. Here again, SMEs are highly vulnerable because of their limited capacity to source their inputs from different suppliers.

… and a heavier debt burden

These new pressures come at a time when many SMEs remain fragile emerging from the pandemic. The 2022 OECD SME Finance Scoreboard showed that SMEs are coming out of the COVID-19 crisis heavily indebted. As interest rates rise, that burden will become heavier and refinancing more challenging. This casts further doubt over their survival and their ability to undertake necessary investment for the twin – green and digital – transition.

Governments are stepping up support…

With the experience from two years of pandemic, Governments have been quick to support SMEs – in particular with measures to compensate rising energy prices. In March 2022, the European Commission announced a new State-Aid Temporary Crisis Framework to enable Member States to grant aid to companies affected by the crisis. Many countries pressed ahead with support measures: the Estonian compensation scheme for gas prices, the Greek programme to help households and businesses deal with rising energy prices and the French Plan de résilience économique et sociale.

We also see efforts to support SMEs to find new trading partners. These include the Austrian Support package, “Resilience through Market Diversification”; Latvian support for companies that exported to the Ukraine; and Japan’s support of SMEs in diversifying their exports.

… but need to focus on the longer term prize

These measures will be essential to the survival of many SMEs. But it will be important that short-term subsidies do not distract from, or delay longer-term transitions. In the EU, National Recovery and Resilience Plans have been developed which should help support longer-term SMEs’ investment needs, in particular to support their energy transition. Policy makers will need to monitor short-term measures closely to ensure they work to support, rather than counteract, longer-term objectives.

This article was originally published by Cogito.