JUNE 8, 2022

Fertilizer prices have increased drastically, +230%, since May 2020. Now—driven upward by supply disruptions stemming from the Russia-Ukraine conflict—they are nearing the peak reached in August 2008 during the last major food price crisis. Spiking fertilizer prices are likely to have major impacts on agriculture and food production—and thus, food security—around the world, as farmers struggle to pay for a key input and face potential supply disruptions, and governments look for ways to cushion the economic blow.

Figure 1

Photo credits: David Laborde – FAOSTAT

How should policymakers respond to this complex emerging situation in fertilizer markets—in particular, to reduce impacts on food security?

In this post, we set forth some considerations for policymakers and other stakeholders as they put short term solutions into place to address fertilizer availability and affordability concerns.

1. Maintain global trade to ensure continuing availability of fertilizers

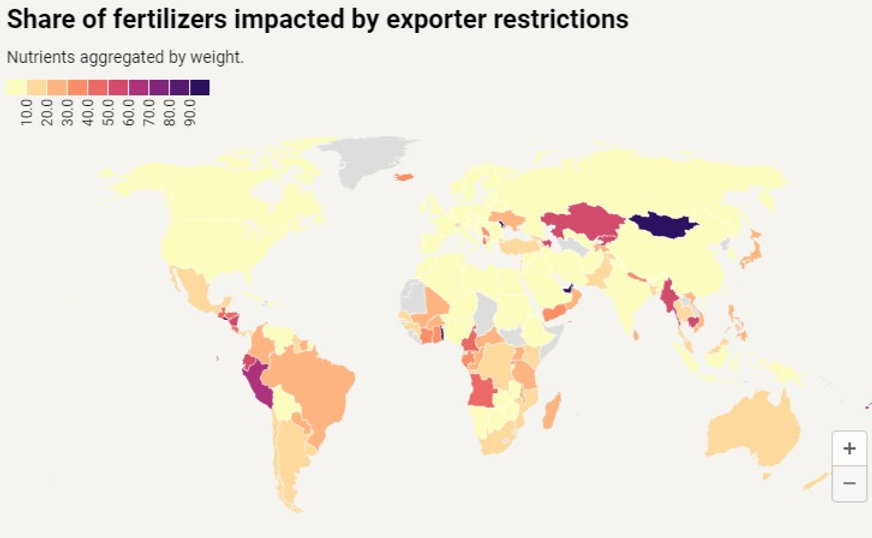

Removing existing export restrictions, and foregoing new ones, is an important priority now. Export bans, stringent inspections and licensing processes, and sanctions that limit availability contribute to supply disruptions and push market prices higher. Currently, such restrictions impact 20% of global trade and threaten more than 50% of fertilizer supply for 24 countries (figure 2). Governments should also designate fertilizers as essential goods to ensure that they can continue to be traded and prioritized in logistical channels.

Figure 2

Photo credits: David Laborde – FAOSTAT

The continuing impacts of economic sanctions on Russia, one of the world’s largest fertilizer producers and exporters, along with Belarus, also a key supplier, should be monitored, with an eye toward understanding their implications for fertilizer producers, traders and buyers around the world. The European Union and U.S. have not imposed sanctions on agricultural products from Russia or Belarus, but they have sanctions in place targeting the main Belarus companies involved in potash production and trade. There is also concern that financial sanctions imposed by the EU and U.S. are hindering trade of Russian and Belarusian food and fertilizers to third countries by impacting logistic and financial operations for many businesses with connections to the agricultural economy. When we combine both export restrictions and export disruptions, 32 countries in the world have one third or more of their fertilizer use at risk.

Governments should provide specific financial and technical solutions to mitigate potential impacts of sanctions on shippers, traders, and others along value chains, so that grain and fertilizers from these two countries can be exported. For instance, “comfort letters” should be issued by major countries, following the example of the United States, to ease the anxiety of financial and insurance companies. Legal helpdesks should be set up to help medium-sized firms involved in fertilizer operations navigate the sanctions, and/or special credit lines guaranteed by public financial institutions for these companies when their private banks decide to suspend operations with Russian counterparts.

An option for governments seeking to secure short-term supplies of fertilizer and/or food is employing a form of “barter trade,” i.e., bilateral deals allowing countries to swap fertilizer shipments for agricultural commodities. Indeed, several fertilizer exporting countries are also traditional grain importers—in particular, some countries in the Middle East and North Africa region.

The goal is not to make such government-to-government trade arrangements a general policy prescription, but to propose a short-term alternative to imposing export restrictions. Such deals could also reduce the temptation of some countries with unsuitable climates or water resources to achieve costly (economically as well as environmentally) food self-sufficiency.

2. Help all farmers increase their fertilizer use efficiency

Just as it’s important to pursue efforts to reduce food loss and waste in the current climate of high agricultural commodity prices, increasing fertilizer use efficiency (the amount of fertilizer applied taken up by crops at harvest) is a crucial priority in a context where supply will remain constrained this year.

Extension services can provide the know-how and tools to facilitate more efficient, crop, site-specific, and integrated nutrient management, which can help to reduce supply pressures while also improving efficiency and minimizing nutrient losses to the environment.

The priority should be educating farmers to implement the “4Rs” (applying the right nutrient source, at the right rate, at the right time, in the right place). To be effective, the 4R principles should be promoted at scale by extension services and private sector actors, as many of the world’s farmers still lack the proper tools, knowledge or incentives to undertake site-specific nutrition management (SSNM).

SSNM was a concept first developed in the 1990s by CGIAR researchers (for rice) and then modernized through tools also developed by CGIAR, such as the International Rice Research Institute’s (IRRI) rice crop manager and the International Institute for Tropical Agriculture’s (IITA) AKILIMO agronomic advisory service for smallholder farmers.

Farmers should also be encouraged to diversify fertilizer sources. A short-term priority here is recycling more livestock manure and considering manure as a resource rather than waste. Proper nutrient management and following the “4Rs” is just as important for manure application as it is for mineral fertilizers to ensure efficiencies and reduce losses to the environment.

3. Support the most vulnerable

Governments will be under pressure to provide relief to farmers facing high fertilizer prices via subsidies and other forms of support. Such assistance should be limited to the most vulnerable farmers in low- and middle-income countries (LMICs), in Africa, Asia and Latin America.

Direct fertilizer subsidies should be temporary, targeted, encourage efficient and balanced plant nutrition, work in tandem with rather than compete with small and medium-sized enterprises (SMEs) in the value chain, and include proper tracking to avoid diversion and smuggling. Regional coordination and harmonized policy responses, also in terms of subsidy regimes, are required to ensure that fertilizers can easily cross borders. Similarly, fertilizer price controls should be avoided since they usually negatively impact input dealers and create black markets.

Additional financial support may also be necessary for some farmers facing high input costs that they cannot recoup because of comparatively low market prices for their crop, e.g., the current situation of rice producers. In addition, social protection measures such as cash transfers or food distribution vouchers should be provided to farmers unable to access fertilizers this year to protect their own food security.

Governments can also provide incentives to smallholder farmers to prioritize the production of food crops over cash crops, and design legal and financial solutions for companies involved in cash crop businesses, allowing greater flexibility a to contract farmers. It is more efficient to compensate cash crop producers for their crops than to subsidize fertilizers for cash crops.

4. Provide financial support for SMEs and fiscally stressed governments

Amid uncertain supplies and volatile prices, LMIC governments should work to ensure that SMEs in the fertilizer value chain have continued access to financing to ensure the ongoing blending and distribution of fertilizers.

The international community will also be called upon to assist LMICs facing high fertilizer prices and supply issues. When such efforts involve financing subsidies, care should be taken that they do not further fuel inflation or create unfair competition between LMICs in need of fertilizers. LMICs in a precarious financial situation due to the economic shocks created by COVID-19 and/or facing acute macroeconomic constraints, such as Sri Lanka, should receive priority support, and such efforts should include a strong grant element to avoid exacerbating debt problems.

5. Ramp up supply in the short run

The best remedy for high prices is increased supply. Typically, brown- and greenfield expansions of fertilizer production imply huge costs and take years to complete, but there is some new capacity coming online in the short to medium run.

The nitrogen (N) market is severely impacted by the current crisis, considering that Russia represents 15% of it globally, export restrictions are impacting 22% of global N trade, and prices for natural gas—central to the N production process—will likely continue to bring instability in European production. But new capacity is coming online in Nigeria and in In India, meanwhile, there are longstanding plans to increase production capacity for urea, a nitrogen fertilizer; five new plants are now at various stages of commissioning. India is currently a large importer of urea, so becoming self-sufficient would free up urea for other markets, though it is still unclear whether this goal is feasible considering the reliance on costly regassified LNG.

The phosphate (P) sector also faces uncertainties regarding Russian exports (14% of global trade), and a further 25% of traded P may be impacted unless China, the top global producer, lifts its export restrictions. Other P-producing countries may be positioned to expand production. In March, for example, —the world’s second-largest phosphate producer—signaled its intention to increase its output by 1 million metric tons in 2022, from the current level of 4 million tons, and to add an additional 3 million tons in 2023.

Potash (K): While some exports of potash from Russia and Belarus may continue, they will likely fall far short of their 2019 combined 37% global market share. With its 34% share of global K trade, attention clearly shifts to Canada. With the price outlook for K improved, an international mining announced plans for a major K production mine and site, while another major Canadian potash producer announced in March its intention to ramp up K production by an additional 1 million tons by the second half of the year—an 8% increase of the total country output.

More capacity could still come online in Canada, and smaller producers such as Germany, Israel, and Jordan could also expand their production in the short term. In the medium run, other players could emerge. A debate is underway in Brazil about potentially mining unused potash resources; however, this could come with very high social and environmental costs. A plan to process phosphate rock imported from Morocco might be a better way to address Brazilian concerns about access to P. But neither approach is feasible in the short run. Care should be taken to ensure that long-term sustainability is not sacrificed to address an immediate crisis.

6. Improve market intelligence and enhance transparency

In this time of rising food insecurity and market volatility, it is vitally important to collect and provide accurate and timely information on fertilizer supply, including on government or private sector reserves. Such data can help governments, producers and consumers avoid making misinformed decisions, including panic buying or hoarding, and avert price manipulation by actors wishing to take advantage of the crisis.

The G20 Agricultural Market Information System (AMIS), convened by the UN Food and Agriculture Organization (FAO) and the Organisation for Economic Cooperation and Development (OECD) should be expanded to include closer monitoring of fertilizer markets. At the same time, initiatives like the IFPRI fertilizer dashboard, along with the data gathering and monitoring efforts of the International Fertilizer Association and AfricaFertilizer.org, should continue to receive support and be integrated in the wider system of agricultural statistics centered around FAO and FAOSTAT, and also provide indicators and tracking for sustainability challenges.

Figure 3: Short-term actions to address the fertilizer crisis

Photo credits: IFPRI

Conclusion

These recommendations offer a variety of ways to blunt the immediate impacts and uncertainty of high fertilizer prices and uncertain supplies for those most vulnerable—farmers in LMICs—and to sustain agricultural production and food security. Governments and organizations should act quickly and judiciously to support farmers, while steering clear of the pitfalls of trade restrictions and high subsidies. We summarize immediate actions required in Figure 3, on which the Group of Seven (G7) and the Group of 20 (G20) countries could and should act now. In our next post, we will examine some longer-term considerations for fertilizer markets and policies.

This article was originally published by IFPRI.